Analyst Predictions Highlight Potential Growth in Invesco MSCI North America Climate ETF

Recent analysis of the Invesco MSCI North America Climate ETF (Symbol: KLMN) indicates promising upside for investors. By comparing the trading prices of KLMN’s holdings with analyst 12-month forward target prices, we found that the ETF’s weighted average implied target price is $28.08 per unit.

Current Price and Growth Potential

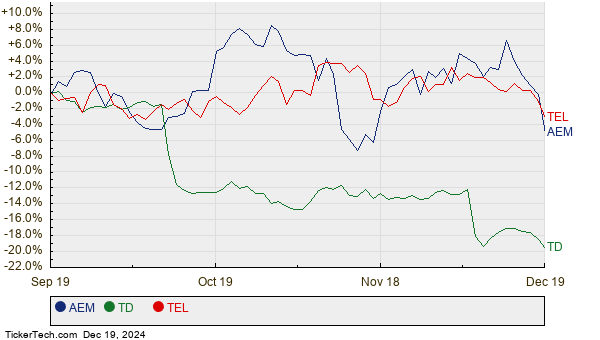

KLMN is currently trading at approximately $24.81 per share, suggesting analysts forecast a 13.18% increase. Among its notable holdings, Agnico Eagle Mines Ltd (Symbol: AEM), Toronto Dominion Bank (Symbol: TD), and TE Connectivity plc (Symbol: TEL) show significant upside potential based on their respective analyst target prices. For instance, AEM has a current price of $77.76 per share, yet analysts predict a target of $93.99, representing an upside of 20.87%. Similarly, TD, priced at $51.81, is expected to reach an average target of $60.85, showing a 17.44% potential increase. TEL, trading at $144.78, has a target price of $167.80, indicating a possible 15.90% rise. Below is a twelve-month price history chart for AEM, TD, and TEL:

Analyst Targets Overview

Here’s a summary of the current analyst target prices for KLMN and its major holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco MSCI North America Climate ETF | KLMN | $24.81 | $28.08 | 13.18% |

| Agnico Eagle Mines Ltd | AEM | $77.76 | $93.99 | 20.87% |

| Toronto Dominion Bank | TD | $51.81 | $60.85 | 17.44% |

| TE Connectivity plc | TEL | $144.78 | $167.80 | 15.90% |

Key Considerations for Investors

Investors may wonder whether these analyst targets are well-founded or overly optimistic regarding future stock performance. Analyst price targets can point to a bright outlook or hint at potential downgrades, often reflecting outdated expectations in light of changing market conditions. It’s crucial for investors to research these factors carefully before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Explore More:

• The Ten Biggest ETFs

• TYPE shares outstanding history

• Top Ten Hedge Funds Holding ZH

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.