American Eagle Outfitters Set to Report Earnings, Analysts Predict Loss

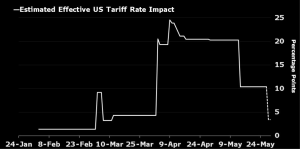

American Eagle Outfitters (NYSE: AEO) will announce its fiscal first-quarter earnings on Thursday, May 29, 2025. Analysts estimate an earnings loss of 22 cents per share on $1.09 billion in revenue. This shows a decline from the previous year’s 34 cents per share and $1.14 billion in revenue. Historically, AEO stock has decreased 60% of the time after earnings announcements, with a median drop of 5.4% and a maximum decline of 14%.

For the year, AEO expects low single-digit sales declines. Current market capitalization stands at $2.0 billion, with annual revenue of $5.3 billion. The company recorded $445 million in operating profits and net income of $329 million last year.

Historical Earnings Performance Insights

Looking at past earnings data over the last five years, AEO experienced 20 recorded instances, with 8 positive and 12 negative one-day returns. Positive returns occurred about 40% of the time, which drops to 36% when narrowing the timeframe to three years. The median of positive returns was 2.4%, while negative returns averaged -5.4%.

A summary table below captures additional data on 5-day and 21-day returns after earnings announcements.

Analyzing 1D, 5D, and 21D Return Correlations

A strategic approach involves examining correlations between short-term and medium-term returns following earnings. Higher correlations can guide trading decisions. For instance, if 1D returns are positive and show the strongest correlation with 5D returns, a trader may choose a long position for the following five days.

AEO Correlation Between 1D, 5D, and 21D Historical Returns

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.