For investors feeling left behind in the whirlwind of technology stocks, there’s a beacon of hope on the horizon. Despite lagging behind the tech-heavy Nasdaq Composite index earlier this year, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) stock is showing signs of life after a robust 2023 performance.

Currently, Alphabet stock has only seen a modest 1% increase in 2024, while the index has soared nearly 7%. But with a robust portfolio that includes the dominant online search engine, the popular YouTube social media platform, and a top-tier cloud computing service, Alphabet stock might be gearing up for a remarkable resurgence.

The Rise of Artificial Intelligence and Cloud Computing

Although Alphabet still heavily relies on advertising for revenue, a recent slowdown in online advertising has left investors wary. Google’s advertising revenue took a more than 10% hit in the fourth quarter of 2023 compared to the previous year.

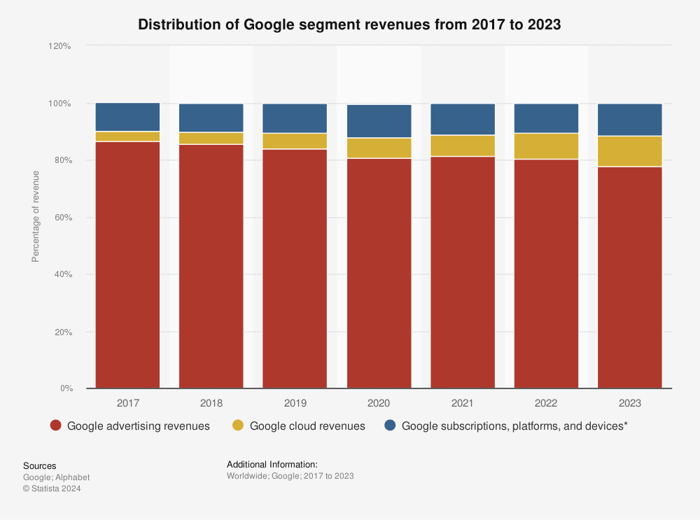

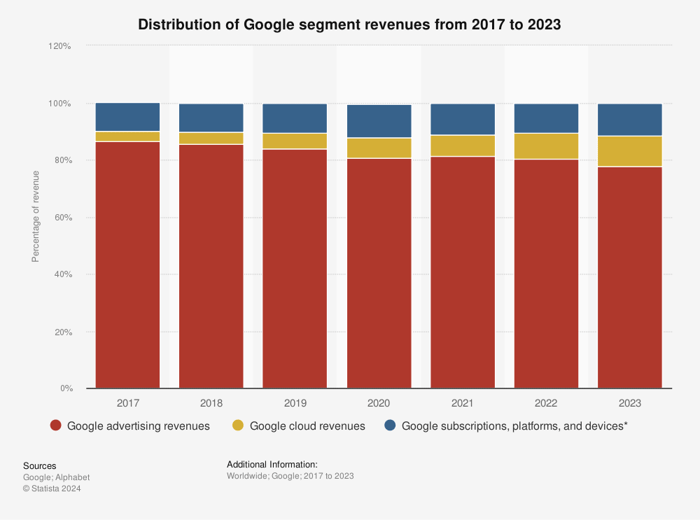

However, Alphabet’s cloud division is rapidly expanding and has significantly increased its revenue contribution over the years. In 2023, Google Cloud accounted for nearly 11% of Alphabet’s total revenue, a substantial jump from just 4.3% in 2018.

Data Source: Statista

While some may believe Alphabet is trailing in the AI race following the debacles around its Gemini AI model, the company holds strong potential in the broader AI landscape. As cloud users increasingly integrate AI tools for business transformation, the demand for computational power is on the rise – a trend exemplified by the soaring revenue of Nvidia from its H100 GPUs.

Understanding the significance of AI in enhancing cloud computing adoption, Tim Potter from Deloitte Consulting highlighted, “Most AI solutions are either services provided directly by cloud hyperscalers or solutions built on top of a hyperscaler’s cloud infrastructure.”

This bodes well for leading cloud providers like Alphabet and is poised to significantly propel its business forward.

Is Investing in Alphabet Worth It?

Before diving into Alphabet stocks, it’s vital to weigh your options:

The analyst team at Motley Fool Stock Advisor recently unveiled their picks for the 10 most promising stocks on the market, with Alphabet missing the cut. These 10 selected stocks hold the potential for substantial returns in the foreseeable future.

Stock Advisor equips investors with a comprehensive roadmap for success, offering portfolio-building guidance, regular updates from analysts, and two new stock selections monthly. Since 2002*, the Stock Advisor service has outperformed the S&P 500 by triple the margin.

Discover the top 10 stocks

*Stock Advisor returns as of March 18, 2024

Suzanne Frey, a board member at Alphabet, serves on The Motley Fool’s board of directors. Howard Smith holds positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool upholds a disclosure policy.

The opinions expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.