Amazon: The Dark Horse in the AI Revolution

Big tech players such as Microsoft, Nvidia, Apple, Tesla, Meta Platforms, Alphabet, and Amazon (NASDAQ: AMZN) are always in the mix when it comes to artificial intelligence (AI) breakthroughs. However, among the “Magnificent Seven,” Amazon stands out as a prime investment opportunity.

Start Your Mornings Smarter! Receive Breakfast news in your inbox every market day. Sign Up For Free »

In the past year, Amazon’s share price has skyrocketed by 49%, outperforming both the S&P 500 and Nasdaq Composite. Yet, I believe the company’s upward trajectory is just beginning.

This article will examine Amazon’s AI development plans and their potential effect on stock performance in the coming years, making a strong case for why it is an excellent investment in the AI space today.

Capital Investments Drive Future Growth

Amazon is often misunderstood, as its main revenue sources come from its e-commerce marketplace and cloud services. However, both sectors face challenges from economic factors like inflation and interest rates, leading to uneven growth. Despite this, Amazon is committed to substantial investments.

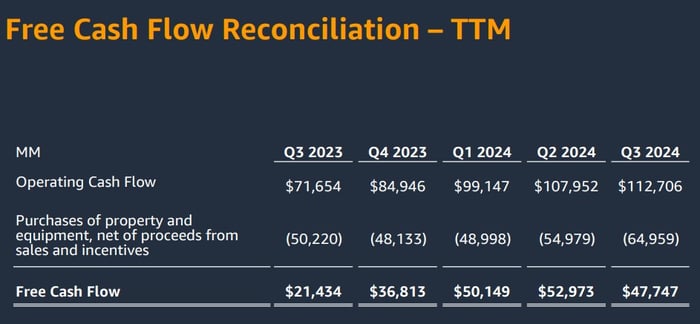

Data source: Investor relations.

The company’s capital expenditure (capex) has increased significantly. While such spending can raise concerns, Amazon’s cash flow has improved dramatically, with operating cash flow up by 57% and free cash flow up by 123% over the last year.

An in-depth look at Amazon’s capex allocations provides more clarity on the company’s future growth potential.

Accelerating Business and Future Prospects

As listed in Amazon’s most recent 10-Q filing, much of the capex is directed towards enhancing “technology infrastructure,” which primarily supports the growth of Amazon Web Services (AWS).

| Category | 3Q23 | 4Q23 | 1Q24 | 2Q24 | 3Q24 |

|---|---|---|---|---|---|

| Amazon Web Services revenue growth — % year over year | 12% | 13% | 17% | 19% | 19% |

| Amazon Web Services operating income growth — % year over year | 30% | 39% | 83% | 72% | 50% |

Data source: Investor relations.

With recent announcements such as developing custom chips, constructing new data centers, and investing $8 billion in AI start-up Anthropic, Amazon’s significant capex investments appear to be yielding results.

As more projects in data center and chip infrastructure come online, investors should anticipate substantial growth in both revenue and profits within the next few years.

Image source: Getty Images.

Positioning for AI Success

The future of Amazon hinges on its AI infrastructure. According to Dan Ives from Wedbush Securities, trillions of dollars are expected to be spent on AI infrastructure in the coming years.

Such trends will benefit major cloud providers like Amazon, with AWS driving most of the company’s profitability. As profit margins expand and cash flow grows, Amazon’s stock valuation is likely to rise significantly.

In three years, Amazon could potentially become the world’s leading AI company, and right now, its stock feels undervalued at just 56 times its free cash flow—approximately half of its five-year average.

This presents a compelling opportunity to purchase Amazon shares. Positive developments appear imminent, and it’s likely that more investors will soon recognize the company’s potential.

A New Investment Opportunity Awaits

Have you ever felt like you missed out on purchasing some of the most prosperous stocks? If so, there’s valuable information ahead.

Sometimes our expert analysts give out a special “Double Down” stock alert for companies they believe are ready to surge. If you’re concerned about possibly missing your investment opportunity, now is an optimal time to buy before any big changes occur. The numbers are noteworthy:

- Nvidia: Investing $1,000 when we doubled down in 2009 would now be worth $365,174!*

- Apple: A $1,000 investment during our 2008 recommendation would have yielded $42,164!*

- Netflix: If you invested $1,000 based on our 2004 advice, it would now be valued at $469,011!*

Our analysts are currently issuing “Double Down” alerts for three exceptional companies, and another chance like this may not come soon again.

Learn more »

*Stock Advisor returns as of January 21, 2025

Randi Zuckerberg, a former director of market development for Facebook and sibling of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is also on this board. Suzanne Frey, an executive at Alphabet, is another board member. Adam Spatacco holds positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool advocates for long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.