Apple’s Stock Soars: What’s Next for 2025?

Shares of Apple (NASDAQ: AAPL) have delivered returns of 33% in 2024 as of this Dec. 30. The stock gained momentum following the release of the fiscal 2024 fourth-quarter results (ending Sept. 28) on Oct. 31.

Investors are feeling optimistic about Apple’s future after those results showcased increases in sales for iPhones, iPads, and MacBooks. Furthermore, the company’s services segment achieved double-digit percentage year-over-year growth during the quarter.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But what does 2025 hold for Apple’s key product lines? Can this technology leader maintain its recent upward trend moving into next year?

Artificial Intelligence: A Key Growth Driver for 2025

For its fiscal Q4, Apple reported a revenue increase of 6% year-over-year to $94.9 billion, while adjusted earnings rose 12% to $1.64 per share, excluding a one-time impact from the European General Court’s State Aid decision. Including that decision, diluted earnings were $0.97 per share, down from $1.46 per share in the same quarter last year.

For the overall fiscal year, revenue climbed 2% to $391 billion, but adjusted earnings fell to $6.08 per share from $6.13 per share in fiscal 2023 (factoring in the court’s impact). This indicates strong growth as the fiscal year ended, largely driven by better sales of iPhones, MacBooks, and iPads.

In 2025, sales of these devices are expected to benefit from the broader adoption of generative artificial intelligence (AI). Apple rolled out its Apple Intelligence suite of AI features in 2024, with further advancements planned for 2025. The gradual introduction of these features is predicted to significantly boost iPhone sales.

For example, IDC projects shipments of iOS-based iPhones to rise by 3.1% in 2025, whereas Android device shipments are forecasted to grow only 1.7%.

Expectations are similarly positive for MacBooks and iPads, as these products will likely see increased sales thanks to AI advancements in 2025. Gartner anticipates a 165% increase in AI PC shipments to 114 million units. As the fourth-largest PC original equipment manufacturer, Apple stands to gain from this growing AI-PC market.

Moreover, the tablet market is also experiencing substantial growth, with shipments up 20% year-over-year in the third quarter of calendar 2024 (according to IDC). As the leading player in tablets with nearly 32% market share, Apple is well-positioned to benefit from Gartner’s forecast of a 9.5% rise in device expenditure in the coming year, driven by consumer interest in AI capabilities.

This suggests that Apple is likely to see faster growth in fiscal 2025 compared to fiscal 2024.

Will Apple’s Stock Keep Rising in 2025?

Analysts covering Apple have set a median 12-month price target of $250 on the stock, which is close to its current trading price, indicating limited short-term upside in 2025. However, they anticipate significant revenue and earnings growth for Apple in fiscal 2025.

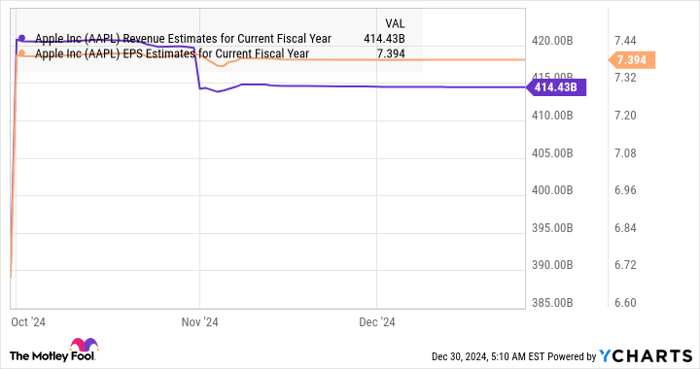

AAPL Revenue Estimates for Current Fiscal Year data by YCharts.

Revenue is expected to rise nearly 6% to $414.4 billion, while bottom-line growth should come in close to 10% at $7.39 per share. If Apple exceeds these estimates, particularly driven by AI-related sales growth, it could see positive market response.

Additionally, the potential for Apple to successfully monetize its AI capabilities could provide a further boost to its services division. Consequently, maintaining Apple stock in one’s investment portfolio could be prudent, as improving market conditions and strong positions in key sectors could enable the stock to sustain its recent growth.

Your Chance to Catch a Potential Investment Opportunity

Ever felt like you missed out on investing in top-performing stocks? Now may be your moment.

Our expert analysts occasionally recommend a “Double Down” stock for companies they believe are poised for significant gains. If you’re concerned you’ve already missed investing in such stocks, this might be the best opportunity to act before it’s too late. The historical performance supports this:

- Nvidia: An investment of $1,000 in 2009 would yield $356,514!*

- Apple: An investment of $1,000 in 2008 would have grown to $47,762!*

- Netflix: If you invested $1,000 in 2004, you would now have $485,594!*

Currently, “Double Down” alerts are being issued for three exceptional companies, and opportunities like this may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.