Dutch Bros Coffee: Navigating Growth Amid Rising Costs

The Dutch Bros (NYSE: BROS) coffee chain has been in business since 1992, yet its current nationwide expansion strategy is relatively new. After entering the public stock market in 2021, Dutch Bros aimed to leverage stock-based funds for its growth. Fast forward three and a half years, and the number of locations has surged from 471 to 982, reaching 18 states, up from 11 in 2021.

The coffee landscape is constantly evolving. The question now is whether Dutch Bros can sustain its ambitious growth amid inflationary pressures and rising coffee prices. Let’s explore the company’s potential trajectory over the next three years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Adapting to Rising Coffee Prices

One of Dutch Bros’ key advantages is its diverse menu, which lessens the company’s vulnerability to rising ingredient costs. In recent years, coffee prices have surged considerably. The producer price index for roasted coffee beans rose from around 170 in mid-2016 to approximately 258 today, reflecting a 16% increase over just the past year.

Although rising ingredient costs pose a challenge, Dutch Bros is managing well. CFO Josh Guenser stated during February’s fourth-quarter earnings call, “We did not see a meaningful impact on our margins due to coffee prices in 2024.” He added that while continued price increases could raise costs by about 1.1%, a recent report indicated a slight decrease in coffee prices, indicating some relief on this front.

Importantly, Dutch Bros isn’t solely reliant on coffee. The company has offered cold beverages, including custom energy drinks, which now account for 25% of sales. This diverse sales mix allows Dutch Bros to thrive despite fluctuations in coffee prices; iced or blended drinks represent the vast majority of its beverage sales, leaving hot drinks to account for just 13% of revenue in 2024.

Inspired by Successful Peers

In light of inflation and increasing wage pressures, Dutch Bros is prepared to adjust its labor costs, a strategy that mirrors successful models in the industry. While labor costs relative to revenue remained stable in 2024, they are projected to rise this year. The management has decided to invest in better wages to foster employee loyalty and satisfaction, acknowledging that friendly service is critical to their business model.

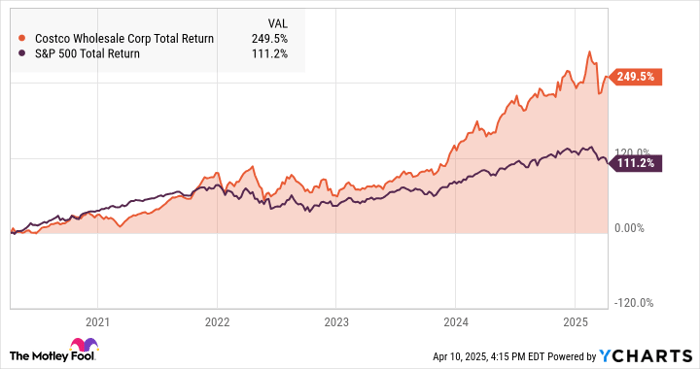

This approach echoes the success seen by Costco (NASDAQ: COST), which has demonstrated that investing in workforce well-being can facilitate business growth through a more efficient workforce. Costco’s policies have produced impressive, market-beating stock returns over the past five years:

COST Total Return Level data by YCharts

Aiming for 4,000 Locations

Despite economic challenges, Dutch Bros seems poised for continued high-growth expansion. The company plans to add around 160 new locations this year, with an ambitious target of reaching 4,000 drive-through windows by 2035. This data-driven growth strategy is bolstered by effective marketing and a distinct service model. Additionally, the company is implementing a coherent expansion strategy by opening new locations near existing ones, which should enhance operational efficiency over time.

Currently, Dutch Bros stock is valued highly, trading at 166 times earnings and 7.3 times sales, reflecting the company’s robust growth. This valuation may deter some investors, especially as the stock has retreated over 34% from its peak in February. Despite this, there could be a good entry point for growth investors if the stock continues to correct.

Looking ahead three years, Dutch Bros could potentially operate around 1,500 stores across 25 to 30 states, with profits likely growing as the company enhances its distribution and sales frameworks. While future stock price growth is uncertain, the groundwork for a compelling long-term growth narrative is being laid.

Eventually, Dutch Bros might also explore international expansion. It will be interesting to see how the whimsical company could celebrate its first store in Amsterdam, showcasing its potential for quirky global growth.

Is Dutch Bros a Smart Investment Now?

Before investing in Dutch Bros, you should consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now—and Dutch Bros is not among them. The selected stocks have the potential to yield substantial returns in the coming years.

For instance, Netflix was recommended in December 2004… a $1,000 investment would be worth $496,779 today!*

Similarly, Nvidia was recommended in April 2005… turning your $1,000 investment into $659,306!*

Notably, the average return for Stock Advisor stands at 787%—significantly outpacing the S&P 500’s 152%. Stay updated on the top 10 list by joining Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 10, 2025

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.