Stock Market Faces Continued Turbulence: What Investors Need to Know

Editor’s note: “Brace Yourself for More Stock Market Turmoil Ahead” was previously published with the title “Painful Stock Market Chaos: You Ain’t Seen Nothin’ Yet” in April 2025. It has since been updated to include the most relevant information available.

If you are feeling perplexed or uneasy watching the Stock market this year, you are not alone. This year has seen one of the most turbulent starts Wall Street has ever experienced.

Market Movements and Reactions

Since January, here has been the market activity:

- A 10% correction in the S&P 500 within 20 trading days (from February to March).

- A sharp 10% drop occurring in just two days in early April, a phenomenon that has only happened five times in the last century during significant crises like the Great Depression and the 2008 financial collapse.

- One of the largest single-day rallies, with the Dow Jones Industrial Average increasing by 7.9% on April 10, marking its largest gain since March 2020. The S&P 500 and Nasdaq also saw remarkable rises, with increases of 9.5% and 12.2%, respectively.

- A downturn at the start of the first-quarter earnings season, leading all three major indices to close lower.

- Recently, the market rebounded significantly, with the Nasdaq up 6.7%, the S&P 4.6%, and the Dow 2.5%, triggering rare bullish technical buy signals.

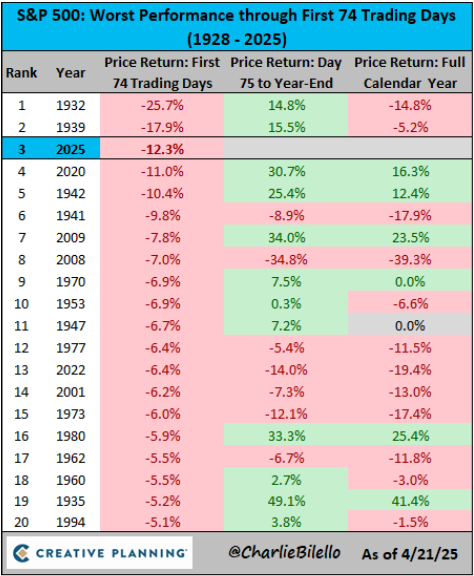

While the market showed signs of recovery, just last week it was on track for its third-worst year on record, having dropped over 12% in the first 74 trading days. Historical comparisons show that the only two years with worse beginnings were 1932 and 1939, during the Great Depression.

What Triggered This Market Chaos?

The root of this turmoil can be traced back to what has been termed “Liberation Day.”

This pivotal day saw U.S. President Trump initiate sweeping tariffs against nearly every U.S. trading partner, creating ripple effects throughout global trade and causing consumer confidence to plummet. Treasury yields increased, and panic spread across Wall Street.

- In retaliation, China imposed tariffs on 128 American products, including a 25% tariff on aluminum, cars, and pork, along with a 15% tariff on fruits and steel piping.

- Trump responded by increasing tariffs on Chinese goods to as much as 125%.

- The White House paused tariffs on some trading partners but continued to raise tariffs on China.

- Electronics were eventually exempted, with discussions about potential auto part exemptions.

- Despite claims of productive talks with trading partners, tangible results have been elusive, while new probes for tariffs on semiconductors and pharmaceuticals have emerged.

The current situation often feels more like a political drama than a stable market environment. Investors, from large hedge funds to everyday individuals, find themselves navigating in a haze of uncertainty.

What Lies Ahead?

Despite the ongoing turmoil, many analysts suggest that this may only be the beginning of greater market shocks ahead.

Currently, around $7 trillion is parked in money-market funds, accruing about 4.5% as investors await a market catalyst. This situation is being described as a potential prelude to a “Summer Panic” in 2025.

An anticipated market event is scheduled for May 7, which analysts believe could spark significant market movements. With historical precedence showing similar setups leading to a rapid influx of cash into stocks, including a notable instance in 1997, many are bracing for what comes next.

As the market evolves, the opportunity often accompanies chaos. Preparation and strategic positioning are crucial. With adequate foresight, investors may find ways to benefit amidst the uncertainty.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at [email protected].