Market Volatility Concerns Grow

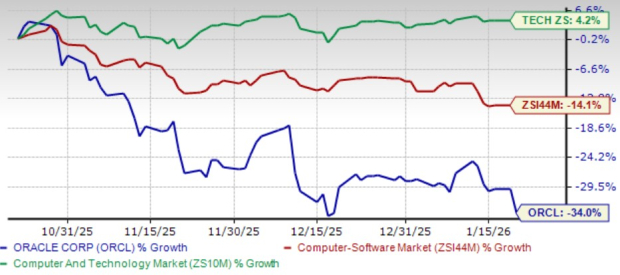

A December 2025 survey by financial association MDRT reveals that 80% of Americans are concerned about an impending recession. This follows the Buffett indicator, which measures the total value of U.S. stocks against GDP, currently at a record high of 223%, indicating potential market risk.

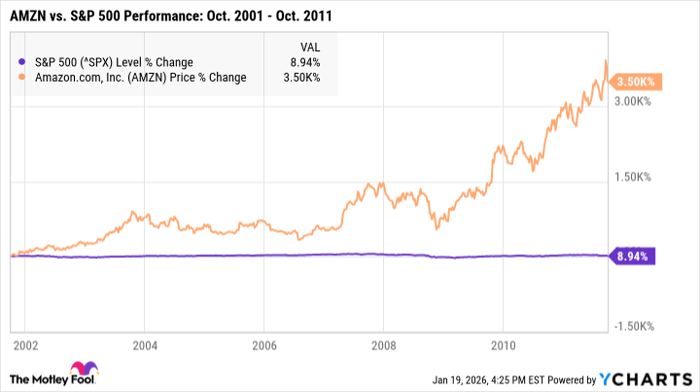

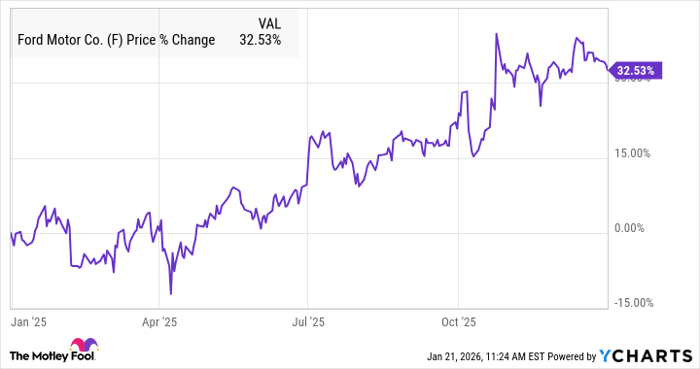

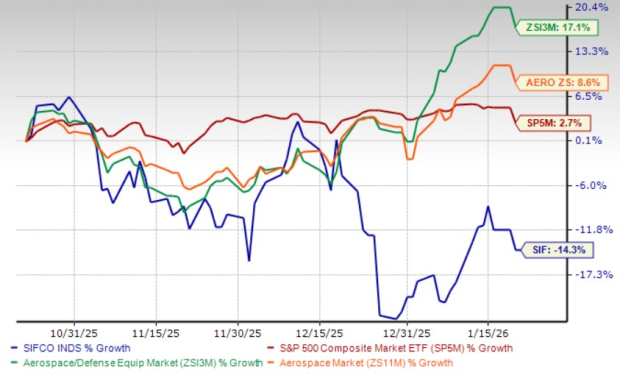

Investors are advised to prepare their portfolios as recession fears heighten. Historical patterns suggest that while downturns are inevitable, investing in strong companies with solid fundamentals can lead to long-term growth even in volatile market conditions.

With the average return of the Stock Advisor program at 930% compared to 192% for the S&P 500, analysts recommend identifying robust stocks for investment during uncertain times.