IBM Prepares for Q1 2025 Earnings Report Amid Mixed Financial Indicators

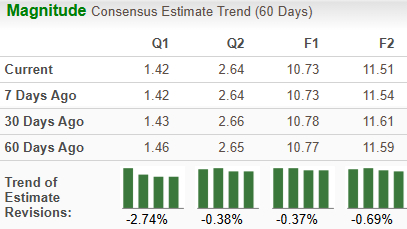

International Business Machines Corporation (IBM) is set to announce its first-quarter earnings for 2025 on April 23. The Zacks Consensus Estimate predicts sales of $14.45 billion and an earnings per share (EPS) of $1.42. However, earnings estimates for 2025 have declined slightly, dropping from $10.77 to $10.73 over the past 60 days. Similarly, 2026 estimates fell from $11.59 to $11.51.

Current Earnings Estimate Trends

Image Source: Zacks Investment Research

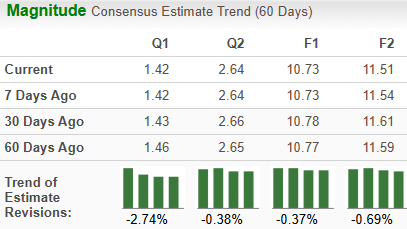

Historical Earnings Surprise

IBM has demonstrated a consistent ability to beat earnings expectations, achieving an average surprise of 6.1% over the past four quarters. In the latest quarter, the company recorded a surprise of 5.1%. To stay updated with market developments, visit the Zacks earnings Calendar.

Image Source: Zacks Investment Research

Earnings Expectations

Currently, our analysis indicates that an earnings beat for IBM in Q1 is unlikely. Successful predictions typically rely on a combination of a positive earnings surprise prediction (ESP) and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). IBM’s current data shows an ESP of -1.68% and a Zacks Rank of #3. You can find the latest list of Zacks Rank #1 stocks here.

Key Developments Impacting Upcoming Results

In the upcoming quarter, IBM has partnered with Walmart’s white-label delivery service, Walmart GoLocal. This collaboration aims to simplify the operational workflows for retailers, providing them with an intuitive and customizable platform integrated with Walmart’s capabilities. Furthermore, IBM has deepened its partnership with Juniper Networks, Inc. to enhance productivity in core enterprise functions.

As per the renewed agreement, IBM plans to integrate its watsonx platform with Juniper’s Mist AI to simplify IT network management, which could improve user experience and reduce operational costs. These collaborations are expected to yield incremental revenue for the Consulting segment, with a Zacks Consensus Estimate for revenue set at $5.1 billion, compared to our projection of $5.17 billion.

Additionally, IBM has expanded its alliance with NVIDIA Corporation (NVDA), focusing on AI workloads and new AI applications. This agreement aims to introduce content-aware storage capabilities for its hybrid cloud infrastructure (IBM Fusion) and enhance watsonx integrations with NVIDIA. This initiative will help businesses adopt hybrid AI solutions, improving data management, performance, security, and governance.

Moreover, IBM has finalized the acquisition of HashiCorp Inc. for $6.4 billion, which is expected to bolster growth initiatives in critical areas like Red Hat, watsonx, and IT automation. The Zacks Consensus Estimate for revenue in the Software segment is $6.27 billion, with our model anticipating $5.97 billion.

Despite advancements in hybrid cloud and AI, IBM faces tough competition from Amazon Web Services and Microsoft Azure. Additionally, the company is undergoing a challenging transition towards cloud services, compounded by weaknesses in traditional business areas and and foreign exchange volatility, all of which pose significant challenges. Heightening pricing pressure is also impacting profit margins, with ongoing declines in profitability save for isolated recoveries.

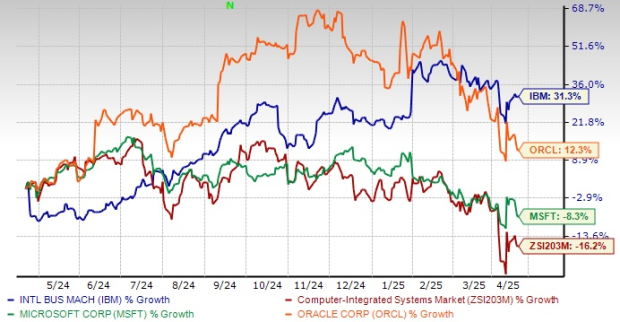

Recent Stock Performance

In the past year, IBM’s stock has appreciated by 31.3% compared to an industry decline of 16.2%. This performance exceeds that of competitors like Microsoft Corporation (MSFT) and Oracle Corporation (ORCL), with Oracle gaining only 12.3% and Microsoft facing an 8.3% drop. Additionally, IBM announced plans to acquire Applications Software Technology LLC, an Oracle consultancy firm, further building on its previous acquisition of Accelalpha in 2024. This strategic move enhances IBM’s ability to assist clients with Oracle cloud solutions.

Image Source: Zacks Investment Research

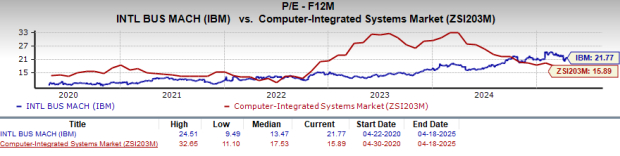

Valuation Insights

In terms of valuation, IBM’s stock trades at a premium relative to its industry counterparts. The company currently sports a forward price/earnings ratio of 21.77, which is higher than the industry average of 15.89 and surpasses its own historical mean of 13.47.

Image Source: Zacks Investment Research

Strategic Outlook

IBM intends to capitalize on increasing demand from businesses looking to leverage advanced technologies. By enhancing its portfolio through strategic partnerships and acquisitions, the company aims to better position itself within competitive markets.

IBM Faces Challenges Amidst Growing Cloud and AI Demands

IBM is adopting a cloud-agnostic and interoperable strategy focused on managing multi-cloud environments, particularly in hybrid cloud and generative AI solutions. As demand for traditional cloud-native workloads surges, coupled with the rapid deployment of generative AI and the advent of quantum computing, enterprises are now tasked with overseeing an increasingly complex array of cloud workloads. This situation has created a significant appetite for innovative infrastructure strategies.

However, IBM’s strategy of frequent acquisitions has introduced integration risks that complicate its operational landscape. These buyouts have adversely affected the company’s financial stability, resulting in high levels of goodwill and net intangible assets on its balance sheet. Additionally, limited opportunities for cost reduction and substantial competitive pressures may have constrained IBM’s profit margins, potentially delaying the launch of critical products.

Market Insights

Currently, IBM’s stock is trading at elevated valuation metrics, prompting investors to consider waiting for a more favorable entry point aligned with its long-term potential. As earnings estimates continue to decline, market sentiment has turned negative. Consequently, this may suggest caution for investors considering the stock in the immediate term.

Despite these challenges, IBM envisions growth primarily driven by its analytics, cloud computing, and security services. The company aims to enhance its business mix and achieve improved operating leverage by focusing on productivity gains and ramping up investments in growth opportunities. This approach positions IBM to capitalize on the robust demand for hybrid cloud services and AI, which are anticipated to stimulate growth in its Software and Consulting segments over time.

Zacks Research Highlights Promising Stocks

Zacks Research’s Director of Research, Sheraz Mian, recently identified “Stock Most Likely to Double.” This expert team highlights five stocks with the highest likelihood of gaining over 100% in the upcoming months, singling out one particularly capable candidate.

This standout stock belongs to a leading financial firm that has experienced rapid customer base expansion, now exceeding 50 million. With a wide range of cutting-edge solutions, it is poised for substantial growth. While not all selections guarantee success, this stock is positioned to outperform previous Zacks stock picks, such as Nano-X Imaging, which saw a remarkable 129.6% increase within a mere nine months.

Free: See Our Top Stock and Four Runners Up

To access the latest recommendations from Zacks Investment Research, download the “7 Best Stocks for the Next 30 Days” report. Click here for your free copy.

Available Stock Analysis Reports:

- Microsoft Corporation (MSFT): Free Stock Analysis Report

- International Business Machines Corporation (IBM): Free Stock Analysis Report

- NVIDIA Corporation (NVDA): Free Stock Analysis Report

- Oracle Corporation (ORCL): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.