Guess?, Inc. to Face Revenue Growth but Bottom-Line Decline

Guess?, Inc. (GES) is expected to report revenue growth for Q1 fiscal 2026 on June 5. The Zacks Consensus Estimate for revenues stands at $631 million, indicating a 6.6% increase from the same quarter last year.

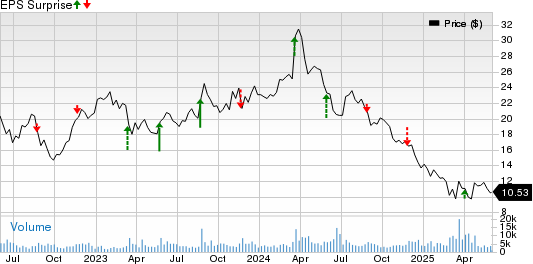

On the other hand, GES is anticipated to suffer a bottom-line decline. The consensus estimate for the loss is unchanged over the past month at 70 cents per share, a marked deterioration from the 27-cent loss reported in the previous year. The company has an average earnings surprise of 2.6% over the last four quarters.

Guess?, Inc. Price and EPS Surprise

Guess?, Inc. price-eps-surprise | Guess?, Inc. Quote

Key Factors Influencing GES’ Q1 Earnings

The operating environment for Guess? has become increasingly complicated, driven by economic pressures and changing consumer behaviors. Customers are more price-sensitive due to ongoing inflation and economic uncertainty. This shift is forcing consumers to opt for value purchases instead of premium items, straining GES’s pricing strategy and impacting sales, particularly in North America and Asia.

Additionally, elevated freight costs, particularly in Europe, are impacting profitability. In its fiscal Q4 earnings call, the company reported rising shipping expenses, contributing to increased operational costs. Moreover, higher selling, general, and administrative (SG&A) expenses are arising from increased marketing and infrastructure investments, putting additional pressure on margins.

Guess? expects to report an adjusted loss of 74 to 65 cents per share for the quarter. On a GAAP basis, the anticipated loss is between 75 and 66 cents per share. The company also forecasted net currency headwinds for fiscal 2026, with the most significant impact expected in Q1.

Despite these challenges, Guess? is diversifying its product portfolio and expanding direct-to-consumer channels. The company is also focusing on effective cost management. Positive results have been noted in wholesale operations, especially in European and Americas markets, with a revenue growth expectation of 5.8% to 7.5% for Q1 fiscal 2026.

GES Earnings Predictions

Current data does not support a firm prediction of an earnings beat for Guess?. The company has a Zacks Rank of #5 (Strong Sell) and an earnings ESP of 0.00%, indicating diminished prospects for outperforming earnings expectations.

Stocks with More Favorable Earnings Predictions

Other companies demonstrating a higher likelihood of beating earnings include:

Dollar Tree (DLTR) has an earnings ESP of +5.49% and a Zacks Rank of 3. However, its revenues are projected to decline to $4.54 billion, a 40.5% drop year-over-year. The earnings estimate is $1.19 per share, down 16.8% from the previous year.

The Kroger Co. (KR) has an earnings ESP of +0.38% and a Zacks Rank of 3, with revenues expected to reach $45.38 billion, a slight 0.3% increase from last year. The consensus estimate for earnings is $1.44 per share, a 1% rise from the previous year.

Victoria’s Secret & Co. (VSCO) holds an earnings ESP of +54.55% and a Zacks Rank of 3. Estimated earnings are 4 cents per share, down from 12 cents last year, with revenues projected at $1.33 billion, a 2.1% decline year-over-year.