Lessons From SoftBank’s Masayoshi Son: Caution in the Age of AI

Hello, Reader.

Tom Yeung here with today’s Smart Money.

In early 2000, Masayoshi Son, founder, chairman, and CEO of SoftBank Group Corp. (SFTBY), was on top of the world. His early investment in Yahoo in 1995 had turned him into a financial hero, while rising dot-com values gave him even more capital to work with.

Instead of investing in high-priced dot-com giants like Microsoft Corp. (MSFT), Son chose to pour money into Alibaba Group Holding Ltd. (BABA), a relatively unknown Chinese e-commerce startup that was much less valued than its American peers.

That gamble was a success. Son’s initial $54 million investment mushroomed into over $72 billion — a staggering 1,300X return — as Alibaba grew into a massive enterprise in the following decades.

Yet, Son’s story is more nuanced than merely high-stakes wins in early-stage startups. As detailed in the new biography Gambling Man, his journey also included poorly timed bets on established companies and many smaller investments that did not pan out.

The increasing value of the SoftBank fund, fueled by profits from Alibaba and outside investments, created pressure for Son to seek out expensive, late-stage companies for investment.

For example, he invested $9.3 billion in ride-hailing company Uber Technologies Inc. (UBER) prior to its initial public offering. This benefitted early Uber investors but left SoftBank facing limited returns.

Moreover, Son’s $5 billion investment in WeWork came at the peak of its market hype, resulting in a substantial loss for SoftBank’s fund.

This history raises questions about Son’s recent $500 million investment in OpenAI, which has drawn skepticism. For this amount, SoftBank is only acquiring 0.3% of the company’s equity in a later stage of its development.

The excitement surrounding OpenAI and other large language model developers is at a fever pitch. There seems to be a rush of latecomers investing heavily in AI companies, often ignoring fundamental valuations.

Recently, Eric raised an important question in the October issue of Fry’s Investment Report: Is it 2000 all over again?

Today’s Smart Money will delve into the significance of being cautious about valuations. I’ll also highlight opportunities in companies that are less expensive than the current AI darlings and discuss where to find these prospects.

Revisiting the Market Trends of 2000

The current stock market mirrors many aspects of the dot-com boom. As Eric noted in his latest report for subscribers, the S&P 500, measured by price-to-earnings (P/E) ratios, sits in the highest 5% of its historical range. Numerous AI startups, lacking profit strategies, are raising capital at billionaire valuations.

Add to this that Masayoshi Son is now steering investments toward AI technologies.

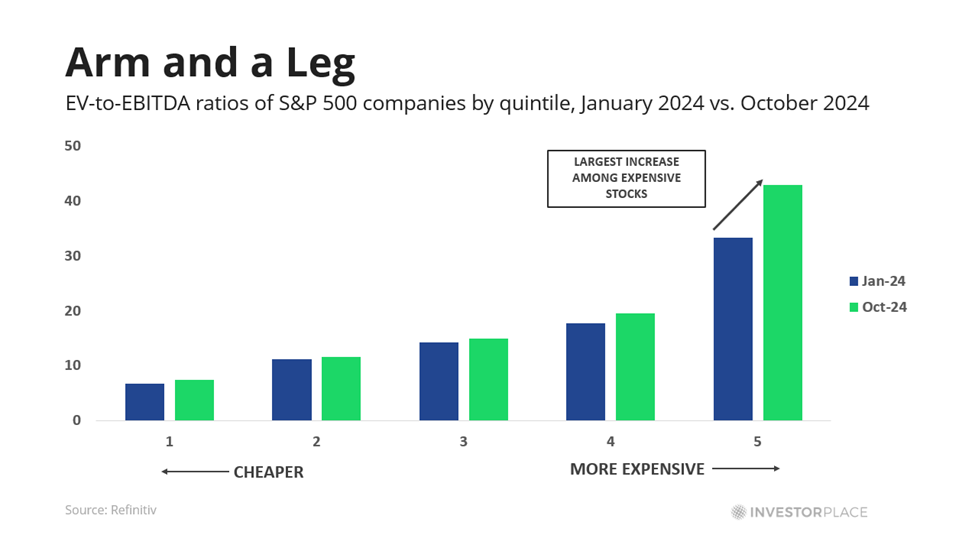

This trend is especially pronounced among high-cost companies. Since January, the EV-to-EBITDA ratios (a measurement considering debt) for the top tier of S&P 500 companies have surged to 42.9X, reflecting a 29% jump from a previous multiple of 33.3X. In comparison, companies in the lower tiers experienced a more modest 7% increase.

Take networking equipment firm Broadcom Inc. (AVGO) as an example; its valuations have gone up by 48%, reaching a 40X EV-to-EBITDA multiple fueled by excitement about AI data centers.

Today, it’s crucial to remain vigilant about valuations, especially with expensive stocks. Many current investments in highly-priced AI companies may not offer the long-term returns investors hope for. For SoftBank, the $500 million stake in OpenAI could be diluted in the coming years due to the company’s rapid cash burn. OpenAI would need to achieve a market capitalization of over $500 billion for SoftBank to break even.

Furthermore, many late-stage AI developers, such as MistralAI and Anthropic, are facing valuations based more on buyout potential than solid cash flow projections. Unlike past buyout transactions, tech giants seem more inclined to develop these technologies internally now.

Even established players like Nvidia Corp. (NVDA) are testing valuation boundaries. Previously, I projected Nvidia’s adjusted stock price could reach $160 by 2027, offering a potential 125% upside at the time of writing. Today, the company’s inflated prices leave only a 20% opportunity for growth.

Overall, for every dollar gained yesterday, a dollar is lost for future potential.

Seeking AI Investments with Real Value

As Eric outlines, some of the most rewarding investments from 2000, 2008, and 2020 were not the obvious choices.

In fact, “boring” sectors like copper and energy have often outperformed pricier tech alternatives. Consequently, Eric has adjusted his portfolio by moving away from the costliest AI bets, such as Amazon.com Inc. (AMZN) and Alphabet Inc. (GOOGL), which he sold for over 100% gains.

Instead, he sees uranium as a promising opportunity aligned with the AI Revolution, and he has recommended a focus on this metal to his subscribers.

However, not all AI companies are overpriced or directly identifiable. So, which AI stocks are reasonably valued and poised for solid performance?

As we’ve discussed, prevailing hype can only take you so far, emphasizing the importance of substance and valuation.

This is precisely the focus of my InvestorPlace colleague, Louis Navellier, who is examining opportunities in AI.

Louis employs a fundamental approach, grounded in quantitative analysis, and he expresses concern that many investors might miss valuable opportunities.

Many are gravitating toward overpriced stocks in the AI space or choosing to stay on the sidelines. Neither is a sound strategy. Louis has put together a presentation that reveals a more strategic approach to investing in AI.

Here’s Louis…

Recklessly investing in “the first generation” of AI stocks is going to cost you dearly in exactly the kind of financial shift I’ve predicted countless times in my 47 years on Wall Street.

However, if you’re aware of what’s ahead and know how to prepare, this year will present exceptional chances to achieve significant profits faster than you may expect.

To access Louis’s latest research broadcast, click here.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace

Thomas Yeung is a market analyst and portfolio manager of the Omnia Portfolio, the highest-tier subscription at InvestorPlace. He is the former editor of Profit & Protection, a free e-letter about investing to profit in good times and protecting gains during the bad.