Progress Software Reports Strong Q1 2025 Results and Raises Guidance

Progress Software (PRGS) saw its shares rise by 14.5% over two trading sessions, closing at $58.98 on Wednesday, after announcing robust first-quarter fiscal 2025 results on Monday. The company reported non-GAAP earnings of $1.31 per share, which outperformed the Zacks Consensus Estimate by 25.96% and marked a 4.8% increase from the previous year.

Additionally, non-GAAP revenues reached $238 million, surpassing the consensus estimate by 0.92%. This figure represents a significant year-over-year growth of 29% on a reported basis and 30% on a constant currency (cc) basis, driven by strong demand for Progress Software solutions, particularly ShareFile.

On a cc basis, Annualized Recurring Revenue (ARR) landed at $836 million, reflecting a 48% increase year over year, primarily owing to contributions from ShareFile and other services. Moreover, the net retention rate has exceeded 100%, further highlighting customer loyalty.

Progress Software Performance Overview

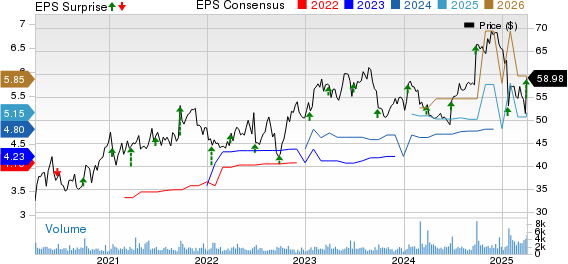

Price, Consensus, and EPS Surprise

Progress Software Corporation price-consensus-eps-surprise-chart | Progress Software Corporation Quote

Quarterly Financial Breakdown

In the first quarter, software license revenues totaled $58.4 million, reflecting an 8.8% decline year over year. Conversely, maintenance and service revenues surged to $179.6 million, indicating a year-over-year growth of 48.9%.

Sales and marketing expenses increased by 40 basis points (bps) from the previous year’s quarter, now standing at 21.6% of revenues. Product development expenses also rose, climbing 50 bps to 19.5% of revenues. However, general and administrative expenses decreased to 10.8% of revenues, an improvement of 80 bps from the prior year. The non-GAAP operating margin for Progress was reported at 39.3%, a contraction of 220 bps compared to the previous year.

Financial Position and Capital Allocation

As of February 28, 2025, the company held cash and cash equivalents totaling $124.2 million, up from $118.1 million as of November 30, 2024. Total debt stood at $1.51 billion, with a net debt position of $1.39 billion. Progress generated an adjusted free cash flow of $73.2 million during this period.

In line with its strategic capital allocation, the company directed $30 million towards debt repayment on its revolving credit line and repurchased an additional $30 million in shares. Consequently, Progress revised its annual share repurchase forecast down from $80 million to $70 million, reallocating the $10 million difference towards debt reduction. By the end of the fiscal first quarter, the balance on PRGS’ revolving credit line was $700 million, with $77 million remaining under its current share repurchase authorization.

Guidance for Fiscal 2025

Looking ahead, non-GAAP revenues for fiscal 2025 are projected to be between $958 million and $970 million, with an expected non-GAAP operating margin of 38%. Projected non-GAAP earnings per share have been raised to an estimated range of $5.25 to $5.37, up from previous guidance of $5.00 to $5.12. Adjusted free cash flow is anticipated to be in the range of $283 million to $294 million for fiscal 2025. For the second quarter, non-GAAP revenues are expected to fall between $235 million and $241 million, with earnings per share projected between $1.28 and $1.34.

Market Position and Stock Considerations

Currently, Progress holds a Zacks Rank of #3 (Hold). In comparison, stocks such as DoorDash (DASH), CSG Systems International (CSGS), and Meta Platforms (META) possess a more favorable Zacks Rank of #2 (Buy). DoorDash shares have appreciated by 13% year-to-date and is scheduled to release its first-quarter 2025 results on May 7. CSG Systems has gained 19.7% year-to-date, also planning to report its first-quarter 2025 results on May 7. Conversely, Meta Platforms has seen a slight decline of 0.2% year-to-date, with its results set to be disclosed on April 30.

Expert Stock Insights

Our research team recently identified five stocks as having the highest potential for +100% gains in the upcoming months. Among these, Director of Research Sheraz Mian has singled out one Stock anticipated to experience significant growth. This highlighted stock belongs to an innovative financial firm boasting a rapidly expanding customer base of over 50 million and offering a diverse range of cutting-edge solutions.

While not all selections will yield gains, this particular stock shows promise for outperforming previous Zacks Stocks Set to Double, like Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: see Our Top Stock And 4 Runners Up.

For the latest recommendations from Zacks Investment Research, download 7 Best Stocks for the Next 30 Days. Click to access this complimentary report.

Progress Software Corporation (PRGS): Free Stock Analysis report.

CSG Systems International, Inc. (CSGS): Free Stock Analysis report.

DoorDash, Inc. (DASH): Free Stock Analysis report.

Meta Platforms, Inc. (META): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.