Analysts Predict Significant Upside for iShares Core Dividend Growth ETF

In our analysis of Exchange-Traded Funds (ETFs) at ETF Channel, we examined the trading prices of holdings compared to the average analyst’s 12-month forward target prices. For the iShares Core Dividend Growth ETF (Symbol: DGRO), the implied analyst target price based on its underlying assets stands at $71.22 per unit.

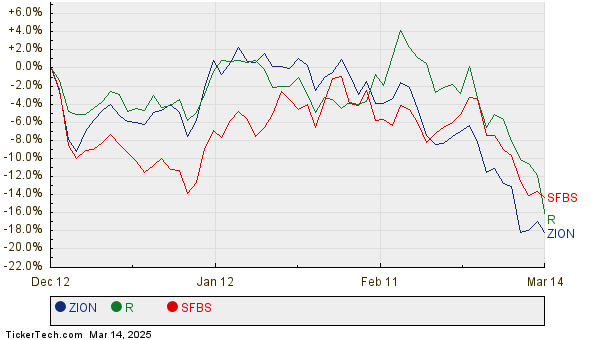

Currently, DGRO is trading at approximately $60.67 per unit, suggesting that analysts anticipate a potential upside of 17.39% based on their target projections for the ETF’s underlying holdings. Notable stocks within DGRO that show significant upside potential include Zions Bancorporation, N.A. (Symbol: ZION), Ryder System, Inc. (Symbol: R), and ServisFirst Bancshares Inc. (Symbol: SFBS). For instance, ZION’s recent price of $47.00 per share is 33.21% below the average analyst target of $62.61 per share. Similarly, R has a potential upside of 22.82% from its current price of $136.38, with a target of $167.50 per share. Analysts expect SFBS, currently at $80.80 per share, to reach a target price of $98.00 per share, indicating a 21.29% upside.

Below is a chart that illustrates the twelve-month price history of ZION, R, and SFBS:

The following table summarizes the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend Growth ETF | DGRO | $60.67 | $71.22 | 17.39% |

| Zions Bancorporation, N.A. | ZION | $47.00 | $62.61 | 33.21% |

| Ryder System, Inc. | R | $136.38 | $167.50 | 22.82% |

| ServisFirst Bancshares Inc | SFBS | $80.80 | $98.00 | 21.29% |

Investors should ask whether analysts are justified in these projections or if they are being overly optimistic about future trading prices. Understanding the rationale behind these targets is essential, especially as high price targets compared to current trading prices may suggest optimism that, if unsubstantiated, could lead to downgrades. These dynamics underscore the importance of thorough research for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• Institutional Holders of CPS

• FRAF YTD Return

• Top Ten Hedge Funds Holding OPGN

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.