Analysts Project Gains for John Hancock Multifactor Large Cap ETF

Our research at ETF Channel has analyzed the trading prices of ETFs in our coverage. For the John Hancock Multifactor Large Cap ETF (Symbol: JHML), we discovered an implied analyst target price of $79.86 per unit based on its underlying holdings.

Market Comparison Reveals Potential Upside

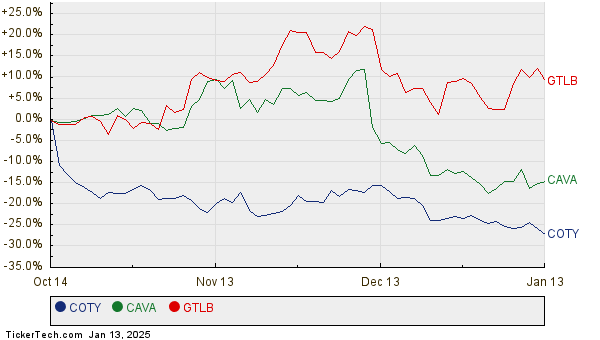

Currently trading at approximately $69.11 per unit, JHML shows potential for a 15.56% increase according to analyst projections. Certain underlying stocks are particularly noteworthy for their upside potential: Coty, Inc. (Symbol: COTY), CAVA Group Inc (Symbol: CAVA), and GitLab Inc (Symbol: GTLB). COTY trades at around $6.67 per share, but analysts expect it to rise by 51.24% to an average target of $10.09. Similarly, CAVA could see a 36.01% increase from its current price of $115.12, targeting $156.57. GitLab is also positioned for growth, with analysts predicting an average target of $80.52, a 34.33% rise from its recent price of $59.94. Below is a chart displaying the twelve-month price history for COTY, CAVA, and GTLB:

Summary of Analyst Expectations

Here is a summary of the current analyst target prices for the ETFs and key holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| John Hancock Multifactor Large Cap ETF | JHML | $69.11 | $79.86 | 15.56% |

| Coty, Inc. | COTY | $6.67 | $10.09 | 51.24% |

| CAVA Group Inc | CAVA | $115.12 | $156.57 | 36.01% |

| GitLab Inc | GTLB | $59.94 | $80.52 | 34.33% |

Considering the Analyst Predictions

Are analysts right in their targets, or too optimistic about these stocks’ future performance? This brings up important questions regarding the analysts’ rationales and their ability to adapt to the latest developments in these companies and the industries they represent. While high target prices can indicate an optimistic outlook, they may also lead to adjustments downward if they prove to be unrealistic. Investors should conduct thorough research before making decisions based on these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• FPRX market cap history

• SRRK shares outstanding history

• PPL Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.