Analyst Target Prices Suggest Significant Upside for PRF ETF

In our analysis of ETFs at ETF Channel, we compared the trading prices of various holdings against the average analyst 12-month forecasts. This examination shows that the Invesco FTSE RAFI US 1000 ETF (Symbol: PRF) has an implied analyst target price of $47.23 per unit based on its underlying assets.

Currently, PRF is trading at approximately $39.40 per unit. This suggests a potential upside of 19.88% according to the average targets set by analysts for these holdings. Notably, three of PRF’s underlying stocks present significant upside based on analyst estimates: O-I Glass Inc (Symbol: OI), Independent Bank Corp (Symbol: INDB), and Enersys (Symbol: ENS).

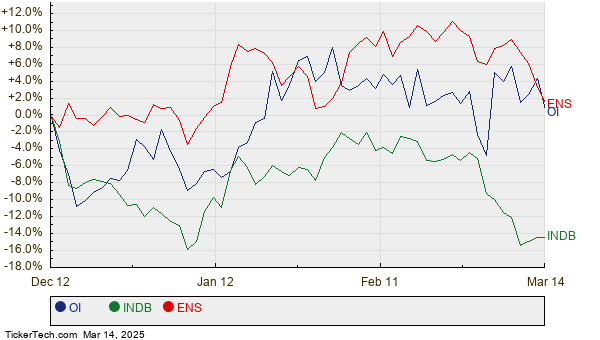

O-I Glass Inc is currently priced at $11.18 per share, while analysts forecast a target price of $14.67, representing an upside of 31.18%. Independent Bank Corp has a recent trading price of $61.37, with a target estimate of $78.25, indicating a potential gain of 27.51%. Enersys shares are priced at $93.98, with an analyst target of $118.67, suggesting a 26.27% upside. Below is the twelve-month price history for OI, INDB, and ENS:

A summary table of the current analyst target prices is as follows:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco FTSE RAFI US 1000 ETF | PRF | $39.40 | $47.23 | 19.88% |

| O-I Glass Inc | OI | $11.18 | $14.67 | 31.18% |

| Independent Bank Corp | INDB | $61.37 | $78.25 | 27.51% |

| Enersys | ENS | $93.98 | $118.67 | 26.27% |

The legitimacy of these targets raises questions: Are analysts being overly optimistic about the future price movements of these stocks? Are their estimates based on sound reasoning, or are they reflective of outdated industry perceptions? A high target price compared to the current trading price might indicate future potential but could also foreshadow possible downgrades if the predictions do not align with new market conditions. Investors should conduct thorough research to navigate these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• AAWW Historical Stock Prices

• AIP market cap history

• Top Ten Hedge Funds Holding OMI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.