Analysts See Upside for Schwab U.S. REIT ETF and Key Holdings

At ETF Channel, our analysis of the underlying holdings within various ETFs reveals insights into potential market performance. For the Schwab U.S. REIT ETF (Symbol: SCHH), the average implied analyst target price is $24.13 per share, based on the 12-month forward targets of its holdings.

Recently, SCHH traded at approximately $20.28 per unit, representing a potential upside of 19.00% according to analysts’ forecasts for the underlying assets. Among the holdings with significant positive outlooks are Apartment Investment & Management Co (Symbol: AIV), Sunstone Hotel Investors Inc (Symbol: SHO), and Veris Residential Inc (Symbol: VRE).

AIV, currently priced at $7.70 per share, has an average target of $11.50, indicating a possible rise of 49.35%. Meanwhile, SHO stands at $8.30, with an average target of $11.00, suggesting a 32.53% upside. Lastly, analysts expect VRE, pegged at $15.25, to reach $20.20, which would signify a remarkable increase of 32.46%.

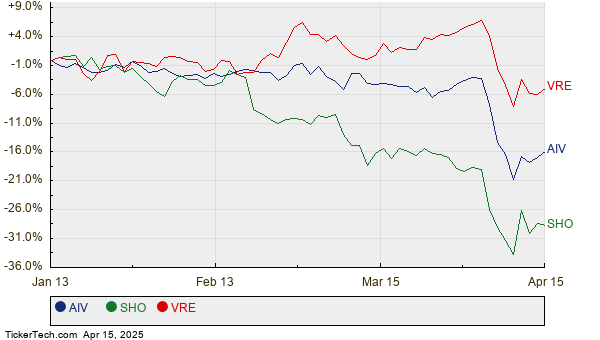

Below is a twelve-month price history chart for AIV, SHO, and VRE:

The summary table below provides a concise look at the mentioned analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Schwab U.S. REIT ETF | SCHH | $20.28 | $24.13 | 19.00% |

| Apartment Investment & Management Co | AIV | $7.70 | $11.50 | 49.35% |

| Sunstone Hotel Investors Inc | SHO | $8.30 | $11.00 | 32.53% |

| Veris Residential Inc | VRE | $15.25 | $20.20 | 32.46% |

Investors might wonder whether analysts’ price targets are justified or overly optimistic for these stocks over the next year. Validating analyst projections is crucial in light of recent developments in individual companies and the broader industry. High price targets may indicate optimism but could also foreshadow potential downgrades if these targets are based on outdated assumptions. Careful research by investors is warranted to understand these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Cheap Midcap Stocks

Top Ten Hedge Funds Holding ECCZ

Funds Holding APXI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.