Analyst Targets Point to Potential Gains for iShares Mid-Cap ETF and Key Holdings

At ETF Channel, we evaluated the underlying stocks within the iShares Core S&P Mid-Cap ETF (Symbol: IJH) to see how their trading prices compare to analysts’ projections. Our findings revealed that the average implied target price for IJH stands at $72.26 per unit.

Current Valuation Implies 9.56% Upside

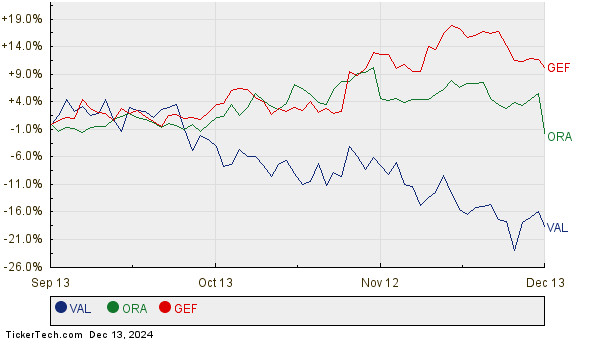

With IJH recently priced at $65.95 per unit, analysts anticipate a 9.56% increase based on the average targets for its holdings. Among these holdings, Valaris Ltd (Symbol: VAL), Ormat Technologies Inc (Symbol: ORA), and Greif Inc (Symbol: GEF) exhibit notable upside potential. VAL, currently trading at $44.16 per share, has a target price 57.45% higher at $69.53 per share. ORA, priced at $74.20, shows a possible upside of 13.78%, aiming for a target of $84.43 per share. Similarly, GEF has an expected target price of $76.40, representing a 13.44% upside from its current price of $67.35. The chart below illustrates the price performance of VAL, ORA, and GEF over the past twelve months:

Summary of Analyst Target Prices

Here’s a table summarizing the recent prices and target prices of the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P Mid-Cap ETF | IJH | $65.95 | $72.26 | 9.56% |

| Valaris Ltd | VAL | $44.16 | $69.53 | 57.45% |

| Ormat Technologies Inc | ORA | $74.20 | $84.43 | 13.78% |

| Greif Inc | GEF | $67.35 | $76.40 | 13.44% |

Do Analyst Projections Hold Water?

The critical question arises: Are these analyst targets justifiable, or do they reflect an overly optimistic outlook for the coming year? Investors must consider whether analysts are keeping pace with current developments affecting these companies and their industries. While high targets can indicate optimism, they can also signal potential downgrades if analysts fail to adjust their expectations based on new information. These are pertinent issues that warrant further exploration by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• MLEC Average Annual Return

• AEGR Videos

• Institutional Holders of RXII

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.