Analysts Predict 12.68% Upside for iShares Core Dividend ETF

At ETF Channel, we analyzed the underlying holdings of the ETFs in our coverage universe. By comparing the trading prices of each holding to their average analyst 12-month forward target prices, we calculated the weighted average implied target price for the iShares Core Dividend ETF (Symbol: DIVB). The result shows an implied target price of $53.00 per unit for DIVB.

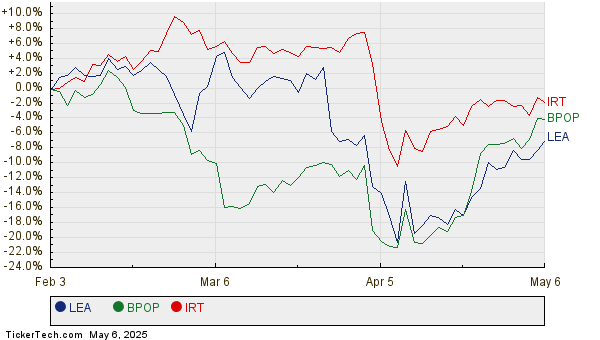

Currently, DIVB is trading around $47.04 per unit, suggesting analysts foresee a 12.68% upside based on these targets. Notably, three underlying holdings of DIVB stand out with significant upside potential: Lear Corp. (Symbol: LEA), Popular Inc. (Symbol: BPOP), and Independence Realty Trust Inc (Symbol: IRT). Lear Corp. recently traded at $88.37 per share, with an average analyst target price of $101.36 per share, indicating a potential 14.70% upside. Similarly, Popular Inc. has a recent share price of $99.48, with a target of $112.44, suggesting a 13.03% upside. For Independence Realty Trust, analysts expect a target price of $21.96 per share, representing a 12.69% increase from its recent price of $19.49. Below is a twelve-month price history chart that tracks the performance of LEA, BPOP, and IRT:

Here is a summary table of the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend ETF | DIVB | $47.04 | $53.00 | 12.68% |

| Lear Corp. | LEA | $88.37 | $101.36 | 14.70% |

| Popular Inc. | BPOP | $99.48 | $112.44 | 13.03% |

| Independence Realty Trust Inc | IRT | $19.49 | $21.96 | 12.69% |

As we assess these targets, it’s important to consider whether analysts are justified in their projections or if they may be overly optimistic. Investors should evaluate if the analysts have valid reasons for their forecasts and remain aware of recent developments in the company and industry. A high target price relative to a stock’s trading price can signal future optimism, but it may also lead to potential downgrades if those targets become outdated. These questions merit further investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets.

10 ETFs With Most Upside To Analyst Targets.

Also see:

● Mortgage REITs Hedge Funds Are Selling

● SOIL shares outstanding history

● COGT YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.