Analyst Projections Suggest Promising Growth for Fidelity Enhanced Large Cap Value ETF

In our latest review at ETF Channel, we analyzed the trading prices of ETF holdings against analysts’ 12-month target prices. Our findings reveal that the Fidelity Enhanced Large Cap Value ETF (Symbol: FELV) has an implied analyst target price of $35.42 per unit based on its underlying assets.

Current Market Price Indicates Potential Gains

Currently, FELV is trading around $30.68 per unit, indicating a potential upside of 15.44% if it meets analysts’ average target prices for its underlying holdings. Notably, three stocks within FELV’s portfolio show significant promise: California Resources Corp (Symbol: CRC), Abercrombie & Fitch Co (Symbol: ANF), and Bio-Rad Laboratories Inc (Symbol: BIO).

Stocks with Strong Upside Potential

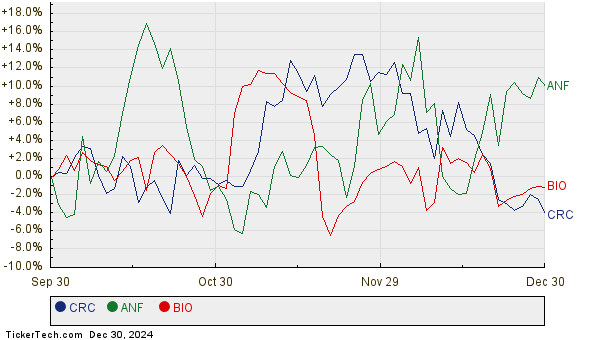

For California Resources Corp, trading at $50.23 per share, analysts have set a target price 36.21% higher at $68.42. Meanwhile, Abercrombie & Fitch Co is currently priced at $153.88, with an expected rise of 21.24% to a target of $186.57 per share. Bio-Rad Laboratories, trading at $330.87, has an analyst target of $395.20, representing a 19.44% potential increase. The performance over the past twelve months for these stocks is illustrated in the chart below:

Summary of Analyst Target Prices

Here is a summary of the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Enhanced Large Cap Value ETF | FELV | $30.68 | $35.42 | 15.44% |

| California Resources Corp | CRC | $50.23 | $68.42 | 36.21% |

| Abercrombie & Fitch Co | ANF | $153.88 | $186.57 | 21.24% |

| Bio-Rad Laboratories Inc | BIO | $330.87 | $395.20 | 19.44% |

Investors Should Consider Analyst Predictions Carefully

As investors assess these targets, it remains to be seen whether the analysts’ expectations are based on solid foundations or if they reflect overly optimistic projections. A high target price can often signal a bright outlook, but it may also lead to future downgrades, especially if market conditions shift. Thorough research into these companies and broader industry trends is advisable for potential investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• KNL shares outstanding history

• IBRN Options Chain

• Top Ten Hedge Funds Holding ASUR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.