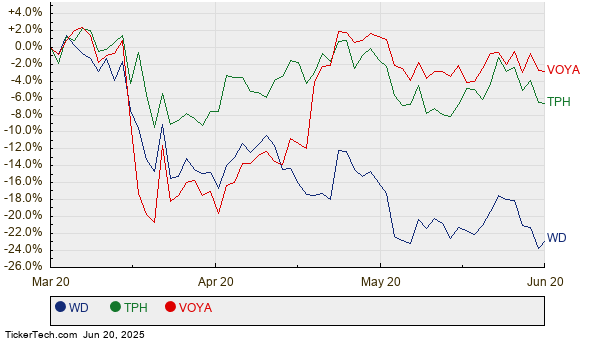

The WisdomTree U.S. MidCap Earnings Fund ETF (EZM) is currently trading at $60.45 per unit, which represents a potential upside of 16.01% to the average analyst target price of $70.13. This analysis, based on comparisons between each holding’s trading price and its respective 12-month forward target price, highlights notable upside for three individual holdings: Walker & Dunlop Inc (WD), Tri Pointe Homes Inc (TPH), and Voya Financial Inc (VOYA).

WD, currently at $66.91, has a target price of $100.00, indicating a potential upside of 49.45%. TPH’s price of $29.89 has a target of $39.71, reflecting a 32.87% upside. VOYA, trading at $66.54, has an average target of $79.50 for a 19.48% increase. Investors are encouraged to conduct further research to assess whether these analyst targets are realistic given recent market developments.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. MidCap Earnings Fund ETF | EZM | $60.45 | $70.13 | 16.01% |

| Walker & Dunlop Inc | WD | $66.91 | $100.00 | 49.45% |

| Tri Pointe Homes Inc | TPH | $29.89 | $39.71 | 32.87% |

| Voya Financial Inc | VOYA | $66.54 | $79.50 | 19.48% |