Analysts Optimistic About FT Energy Income ETF’s Future Gains

As we explore the fortunes of the FT Energy Income Partners Enhanced Income ETF (Symbol: EIPI), analysts highlight a potential upside based on its current trading price and underlying holdings. The ETF’s implied target price stands at $21.77 per unit, suggesting favorable growth prospects.

Current Status and Potential Gains

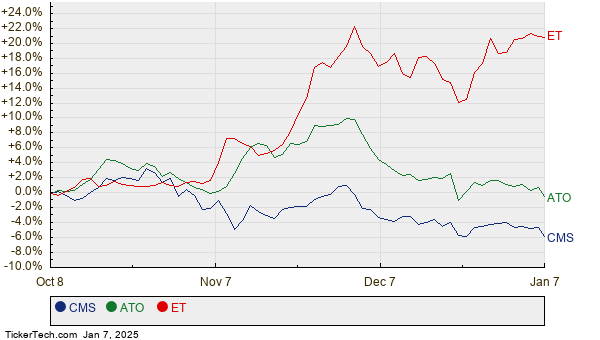

Trading around $19.69 per unit, EIPI presents a projected growth of 10.58% based on average analyst targets. Certain underlying stocks reveal this promising trend. Notably, CMS Energy Corp (Symbol: CMS), Atmos Energy Corp. (Symbol: ATO), and Energy Transfer LP (Symbol: ET) show significant upside potential compared to their current prices. CMS is priced at $65.42 per share, yet analysts anticipate a rise to $72.94, reflecting an increase of 11.50%. Likewise, ATO, currently trading at $136.51, has a target of $151.25, indicating a rise of 10.80%. ET, priced at $19.62, is expected to reach $21.71, a growth of 10.67%.

Performance Insights

These three companies together make up 6.73% of the EIPI ETF. Below is a summary of their current performance against analyst targets:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| FT Energy Income Partners Enhanced Income ETF | EIPI | $19.69 | $21.77 | 10.58% |

| CMS Energy Corp | CMS | $65.42 | $72.94 | 11.50% |

| Atmos Energy Corp. | ATO | $136.51 | $151.25 | 10.80% |

| Energy Transfer LP | ET | $19.62 | $21.71 | 10.67% |

Analyzing the Analyst Targets

The key question remains: are these analyst targets a reflection of realistic market conditions, or do they hint at an overly hopeful outlook? As targets can shift based on ongoing developments, investor research is vital. A high price target may signal optimism, but it can also lead to lowering expectations if market circumstances change.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• AGC shares outstanding history

• Funds Holding NSEC

• IXJ shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.