Analyst Price Targets Indicate Potential Upside for Key ETFs

In analyzing the portfolios of various ETFs within our coverage at ETF Channel, we have compared the trading prices of each holding against their average analyst 12-month forward target prices. This analysis has resulted in a weighted average implied analyst target price for the iShares Core 60/40 Balanced Allocation ETF (Symbol: AOR) of $65.98 per unit.

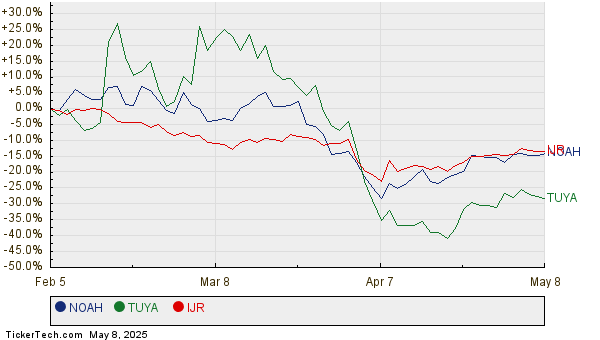

Currently, AOR’s trading price stands at approximately $57.97 per unit. This shows that analysts forecast a potential upside of 13.82% based on the average target prices of its underlying holdings. Notably, three of AOR’s underlying stocks exhibit significant upside potential based on analyst targets: Noah Holdings Ltd (Symbol: NOAH), Tuya Inc (Symbol: TUYA), and the iShares Trust – Core S&P Small-Cap ETF (Symbol: IJR). NOAH’s recent trading price is $9.47 per share, with the average analyst target price set at $12.60 per share—indicating a 33.05% upside. Similarly, TUYA, trading at $2.29, has an average analyst target of $2.95, reflecting a potential gain of 28.82%. Lastly, analysts predict IJR will reach a target price of $128.62 per share, a 26.36% increase over its recent price of $101.79. Below is a chart showing the twelve-month price performance of NOAH, TUYA, and IJR:

Below is a summary table of the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core 60/40 Balanced Allocation ETF | AOR | $57.97 | $65.98 | 13.82% |

| Noah Holdings Ltd | NOAH | $9.47 | $12.60 | 33.05% |

| Tuya Inc | TUYA | $2.29 | $2.95 | 28.82% |

| iShares Trust – Core S&P Small-Cap ETF | IJR | $101.79 | $128.62 | 26.36% |

The question arises: Are the analysts justified in these price targets, or are they overly optimistic regarding future trading levels? Do they have substantial reasoning for their estimates, or are they lagging behind recent developments in the companies and their respective industries? High price targets relative to a stock’s trading price may indicate positive sentiment, yet they can also signal potential downgrades if those targets are based on outdated expectations. Investors should consider these factors when conducting their research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• WWW YTD Return

• Top Ten Hedge Funds Holding FDMO

• Top Ten Hedge Funds Holding VERV

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.