Analyst Predictions Suggest Upside for CCM Global Equity ETF

At ETF Channel, we analyzed the holdings of various ETFs in our coverage universe by comparing trading prices against each stock’s average analyst 12-month forward target price. For the CCM Global Equity ETF (Symbol: CCMG), the implied target price based on its underlying assets is identified at $30.88 per unit.

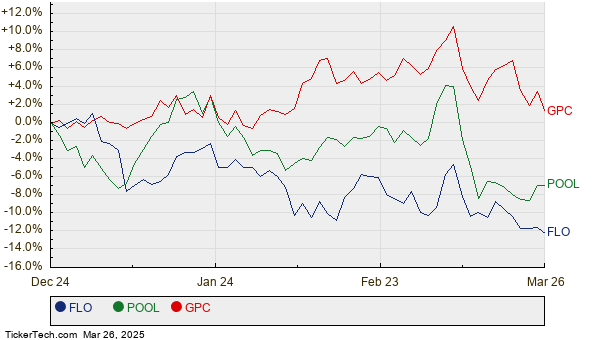

Currently, CCMG is trading at approximately $28.16 per unit, indicating analysts forecast a potential upside of 9.64%. This upside reflects expectations based on the average target prices of its underlying holdings. Three notable stocks contributing to this upside are Flowers Foods, Inc. (Symbol: FLO), Pool Corp (Symbol: POOL), and Genuine Parts Co. (Symbol: GPC). Specifically, FLO is priced at $18.05 per share, while analysts suggest a target of $20.33 per share, suggesting a potential increase of 12.65%. POOL, trading at $325.63, has an average target of $366.50, offering a 12.55% upside. Similarly, GPC’s recent trading price is $117.89, with an average target of $131.11, promising 11.21% upside. Below is a comparison of the twelve-month price performance for FLO, POOL, and GPC:

Here is a summary table of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| CCM Global Equity ETF | CCMG | $28.16 | $30.88 | 9.64% |

| Flowers Foods, Inc. | FLO | $18.05 | $20.33 | 12.65% |

| Pool Corp | POOL | $325.63 | $366.50 | 12.55% |

| Genuine Parts Co. | GPC | $117.89 | $131.11 | 11.21% |

Whether these analyst targets are justified or too optimistic remains an open question. Investors should consider if analysts have adequately adjusted for recent developments or if the bullish forecasts are based on outdated information. A stark difference between current trading prices and high price targets often signals either optimism for future growth or the risk of potential downgrades if those targets do not materialize.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

FVT shares outstanding history

Institutional Holders of NAGS

REXN Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.