Analysts Expect Significant Growth for iShares ESG Aware MSCI USA Small-Cap ETF

Recent analysis from ETF Channel offers insights on the iShares ESG Aware MSCI USA Small-Cap ETF (Symbol: ESML) and its promising growth potential based on current analyst target prices.

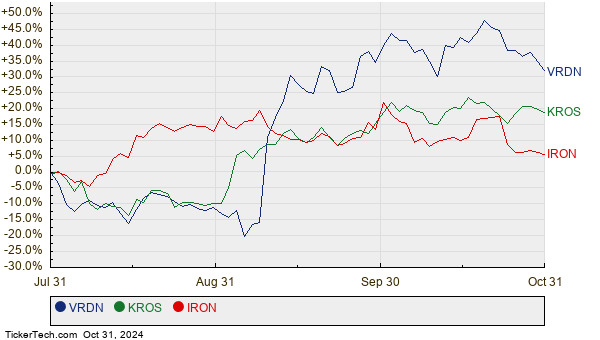

For the ESML, the calculated implied analyst target price stands at $48.02 per unit. Presently, the ETF is trading around $42.04. This indicates a potential upside of 14.23% based on the average targets set by analysts for its underlying holdings. Notably, three underlying stocks show particularly strong prospects: Viridian Therapeutics Inc (Symbol: VRDN), Keros Therapeutics Inc (Symbol: KROS), and Disc Medicine Inc (Symbol: IRON). VRDN is priced at $22.17 per share, while its average target price is $39.07, suggesting a 76.21% upside. Similarly, KROS, which is trading at $59.64, has an average target of $90.90, representing a potential increase of 52.41%. Analysts anticipate IRON to rise to a target price of $69.25 from its current price of $45.60, indicating an upside of 51.86%. Below is a twelve-month price comparison chart for these stocks:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG Aware MSCI USA Small-Cap ETF | ESML | $42.04 | $48.02 | 14.23% |

| Viridian Therapeutics Inc | VRDN | $22.17 | $39.07 | 76.21% |

| Keros Therapeutics Inc | KROS | $59.64 | $90.90 | 52.41% |

| Disc Medicine Inc | IRON | $45.60 | $69.25 | 51.86% |

These differing perspectives require careful scrutiny. Are the analysts’ target projections grounded in realistic expectations, or are they skewed by recent trends in the market? A target price that is significantly higher than the current trading price can indicate optimism for future growth, but it may also lead to potential downgrades if those predictions don’t reflect current market conditions. Investors are encouraged to conduct further research on these developments.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Materials Stocks Hedge Funds Are Buying

• Top Ten Hedge Funds Holding DBC

• RBNC shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.