Analysts See Potential Growth in First Trust Value Line Dividend ETF

Insights into ETF Valuations from Underlying Holdings

At ETF Channel, we analyzed the underlying assets of the First Trust Value Line Dividend Index Fund ETF (Symbol: FVD) and compared their current trading prices to the average analyst’s 12-month target prices. Based on our calculations, the implied target price for FVD stands at $49.57 per unit.

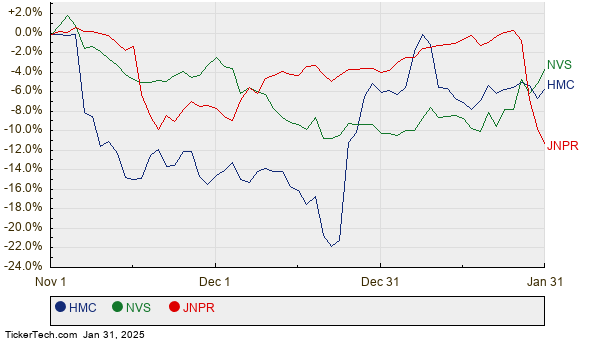

Currently trading around $44.81 per unit, FVD offers analysts a projected upside of 10.62%. Several underlying holdings are also seen as having significant upside potential. Notably, Honda Motor Co Ltd (Symbol: HMC), Novartis AG Basel (Symbol: NVS), and Juniper Networks Inc (Symbol: JNPR) stand out with their respective targets. HMC shares hover at a recent price of $28.67, while analysts project a target price of $38.60, indicating a 34.64% upside. NVS, trading at $104.75, has a target of $119.20, suggesting a 13.79% rise. JNPR, currently valued at $34.38, has a forecasted target price of $38.73, equating to a 12.64% expected increase. The chart below demonstrates the 12-month performance of these stocks:

The following table summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Value Line Dividend Index Fund ETF | FVD | $44.81 | $49.57 | 10.62% |

| Honda Motor Co Ltd | HMC | $28.67 | $38.60 | 34.64% |

| Novartis AG Basel | NVS | $104.75 | $119.20 | 13.79% |

| Juniper Networks Inc | JNPR | $34.38 | $38.73 | 12.64% |

These analysts’ targets raise important questions. Are these estimates grounded in realistic expectations, or might they prove too ambitious over the next year? Investors need to be cautious and conduct thorough research to assess whether these forecasts align with recent changes in their respective industries. A high price target can indicate confidence in future performance but might also signal potential downward revisions if expectations are not met.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Stock Splits

• Institutional Holders of SONM

• SOUN Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.