Analyst Targets Suggest Upside for iShares IGV ETF and Holdings

ETF Channel analyzed trading prices of holdings in ETFs, comparing them to the average analyst 12-month target prices. The iShares Expanded Tech-Software Sector ETF (Symbol: IGV) has an implied target price of $115.84 per unit based on this analysis.

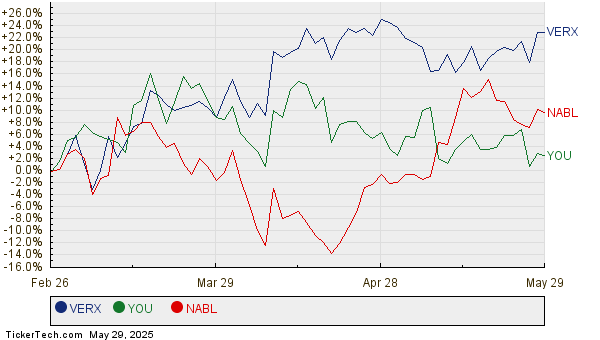

Currently, IGV trades around $103.08 per unit, indicating a potential upside of 12.38% based on the target prices of its underlying holdings. Notable contributors to this upside include Vertex Inc (Symbol: VERX), Clear Secure Inc (Symbol: YOU), and N-able Inc (Symbol: NABL). VERX, with a recent trading price of $39.54, has an average target price of $49.08, suggesting a 24.14% upside. Similarly, YOU’s recent price of $24.36 reflects a 22.13% potential upside to its target of $29.75. NABL is expected to rise to a target price of $8.96 from its current price of $7.89, representing a 13.56% increase.

Below is the twelve-month price history chart comparing the performance of VERX, YOU, and NABL:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Expanded Tech-Software Sector ETF | IGV | $103.08 | $115.84 | 12.38% |

| Vertex Inc | VERX | $39.54 | $49.08 | 24.14% |

| Clear Secure Inc | YOU | $24.36 | $29.75 | 22.13% |

| N-able Inc | NABL | $7.89 | $8.96 | 13.56% |

Investors should consider whether analysts’ targets are justified or overly optimistic. Current targets may indicate future potential, but they could also lead to downgrades if based on outdated information. These factors warrant further investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ETFs Holding PII

• PAL Insider Buying

• APH Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.