Analysts Predict Impressive Upside for iShares S&P Small-Cap ETF

In our recent analysis of ETFs, we examined the holdings of the iShares S&P Small-Cap 600 Growth ETF (Symbol: IJT) against the average 12-month forward target prices set by analysts. The weighted average implied target price for IJT is $152.97 per unit.

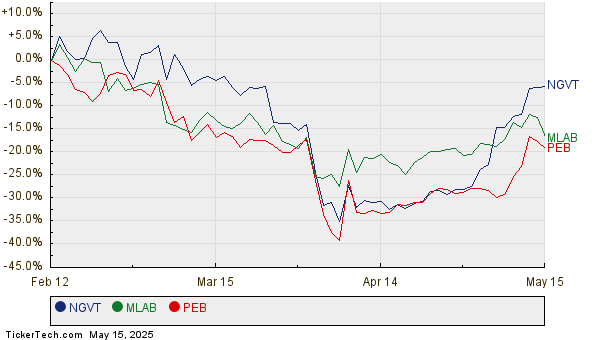

Currently trading at approximately $129.47 per unit, IJT presents an upside potential of 18.15%, according to analysts’ insights on the underlying assets. Among these holdings, three companies stand out with significant upside potential to their respective target prices: Ingevity Corp (Symbol: NGVT), Mesa Laboratories, Inc. (Symbol: MLAB), and Pebblebrook Hotel Trust (Symbol: PEB).

For instance, NGVT is trading at $43.26 per share, while analysts project a target price of $52.00, suggesting a potential increase of 20.20%. Similarly, MLAB’s recent price of $120.10 has an average target of $143.33, indicating a 19.34% upside. Lastly, PEB’s current trading price of $10.22 reflects an 18.84% upside to the forecasted target of $12.14.

Below is a twelve-month price history chart for NGVT, MLAB, and PEB:

Here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares S&P Small-Cap 600 Growth ETF | IJT | $129.47 | $152.97 | 18.15% |

| Ingevity Corp | NGVT | $43.26 | $52.00 | 20.20% |

| Mesa Laboratories, Inc. | MLAB | $120.10 | $143.33 | 19.34% |

| Pebblebrook Hotel Trust | PEB | $10.22 | $12.14 | 18.84% |

Investors might wonder if these analyst targets are reasonable or overly optimistic. Assessing whether analysts have justified their predictions or if they are lagging behind recent developments is essential. High target prices relative to current trading values can indicate optimism, yet may also signal potential downgrades if they reflect outdated assessments. Further research is recommended to gain clarity on these issues.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• RAS Options Chain

• ACFC Insider Buying

• OIC Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.