Analyst Insights on iShares Morningstar Mid-Cap Growth ETF: A Look Ahead

At ETF Channel, we recently conducted an analysis on the iShares Morningstar Mid-Cap Growth ETF (Symbol: IMCG) by comparing trading prices of its holdings against average 12-month analyst target prices. The findings indicate that the implied analyst target price for IMCG is $86.38 per unit.

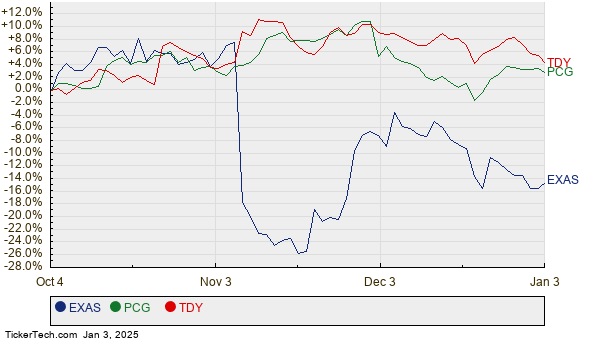

Currently, IMCG is trading around $75.46 per unit. This suggests analysts anticipate a 14.47% increase based on the target prices of its underlying assets. Among IMCG’s notable holdings, three stand out for their potential upside: EXACT Sciences Corp. (Symbol: EXAS), PG&E Corp (Symbol: PCG), and Teledyne Technologies Inc (Symbol: TDY). For instance, EXAS is priced at $56.92 per share, yet analysts predict an average target of $73.05—a significant 28.33% increase. Similarly, PCG’s recent share price is $20.01, indicating a 19.61% potential rise to meet the target of $23.93. Lastly, analysts expect TDY to reach $540.78, an 18.08% jump from its current price of $457.99. Below is a chart illustrating the 12-month stock performance of these companies:

The following table summarizes the current analyst target prices for the companies discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar Mid-Cap Growth ETF | IMCG | $75.46 | $86.38 | 14.47% |

| EXACT Sciences Corp. | EXAS | $56.92 | $73.05 | 28.33% |

| PG&E Corp | PCG | $20.01 | $23.93 | 19.61% |

| Teledyne Technologies Inc | TDY | $457.99 | $540.78 | 18.08% |

Such pricing targets lead to questions about the analysts’ growth expectations: Are they justified, or could they be overly optimistic about the future valuations? Valuations that appear high relative to current prices may signal optimism but could also result in downgrades if market conditions evolve unfavorably. Investors should conduct further research to assess the validity of these targets and the analysts’ perspectives.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Services Stocks Hedge Funds Are Buying

• TWND shares outstanding history

• Funds Holding VCXB

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.