Analysts See Significant Upside Potential for IVOG ETF Holdings

At ETF Channel, we analyzed the underlying holdings of our covered ETFs, focusing on the Vanguard S&P Mid-Cap 400 Growth ETF (Symbol: IVOG). By comparing the trading price of each holding with the average analyst’s 12-month forward target price, we calculated a weighted average implied analyst target price for the ETF, which comes in at $128.06 per unit.

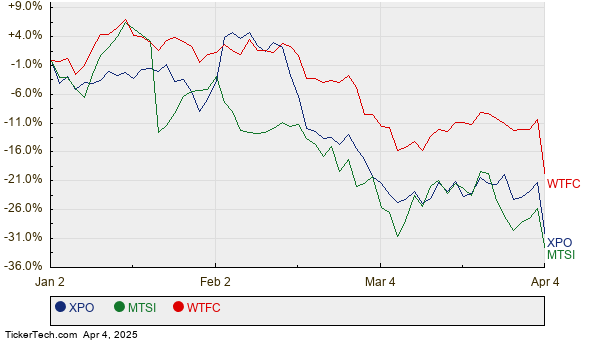

Currently, with IVOG trading at approximately $99.23 per unit, analysts project a 29.06% upside based on the average targets of the underlying holdings. Noteworthy candidates with substantial upside potential include XPO Inc (Symbol: XPO), MACOM Technology Solutions Holdings Inc (Symbol: MTSI), and Wintrust Financial Corp (Symbol: WTFC). XPO is currently priced at $96.01 per share, while its average analyst target is significantly higher at $152.00 per share, indicating a potential 58.32% increase. Similarly, MTSI, trading at $92.17, has an upside of 58.01% with an analyst target of $145.64. Analysts expect WTFC to reach a target price of $146.83, which is 46.97% above the recent price of $99.91. Below is a twelve-month price history chart showing the performance of XPO, MTSI, and WTFC:

Here’s a summary of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 Growth ETF | IVOG | $99.23 | $128.06 | 29.06% |

| XPO Inc | XPO | $96.01 | $152.00 | 58.32% |

| MACOM Technology Solutions Holdings Inc | MTSI | $92.17 | $145.64 | 58.01% |

| Wintrust Financial Corp | WTFC | $99.91 | $146.83 | 46.97% |

Investors may wonder whether analysts’ targets are justified or overly optimistic for these stocks in the next year. It’s essential to consider if there is valid reasoning behind these targets or if they fail to reflect recent company and industry developments. A high target relative to a stock’s trading price might signal future growth, yet it can also foreshadow potential target price downgrades if those estimates are out of line with current realities. Investors should conduct thorough research to address these questions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• RNST YTD Return

• AMU Historical Stock Prices

• AMP Average Annual Return

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.