Analyst Target Prices Indicate Significant Upside for iShares Russell 1000 ETF

At ETF Channel, we analyzed the underlying holdings of the ETFs in our coverage universe. We compared the trading price of each holding to the average analyst 12-month forward target price, allowing us to calculate the weighted average implied analyst target price for the iShares Russell 1000 ETF (Symbol: IWB). Our findings show that the implied analyst target price for IWB is $372.28 per unit.

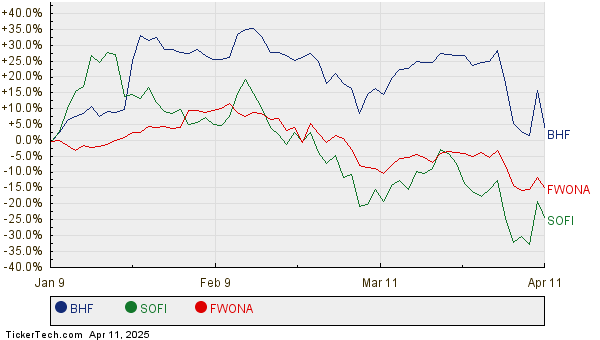

Currently, IWB trades near $287.74 per unit. This suggests that analysts anticipate a potential upside of 29.38% for this ETF, based on the average analyst targets of its underlying holdings. Among IWB’s holdings, three companies stand out with significant potential upside: Brighthouse Financial Inc (Symbol: BHF), SoFi Technologies Inc (Symbol: SOFI), and Liberty Media Corp – Formula One Group (Symbol: FWONA). For instance, despite BHF’s recent trading price of $47.29 per share, the average analyst target sits at $61.90 per share, indicating a 30.89% increase. Similarly, SOFI shows potential for a 30.60% rise from its recent price of $10.52 to an average target of $13.73. Analysts predict that FWONA could reach a target price of $92.83 per share, reflecting a 30.02% upside from its current price of $71.40. Below is a twelve-month price history chart comparing the stock performance of BHF, SOFI, and FWONA:

Here is a summary table of the current analyst target prices mentioned above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell 1000 ETF | IWB | $287.74 | $372.28 | 29.38% |

| Brighthouse Financial Inc | BHF | $47.29 | $61.90 | 30.89% |

| SoFi Technologies Inc | SOFI | $10.52 | $13.73 | 30.60% |

| Liberty Media Corp – Formula One Group | FWONA | $71.40 | $92.83 | 30.02% |

Investors may wonder whether analysts are justified in these targets or if they might be overly optimistic about the future performance of these stocks. As high target prices may indicate optimism, they can also serve as precursors to target price downgrades if they no longer reflect recent company and industry developments. Thus, further research is recommended for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• PECK YTD Return

• RPG Options Chain

• SPNT Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.