Analysts Predict Growth for Fidelity Nasdaq ETF Amid Stock Price Insights

At ETF Channel, we’ve analyzed the underlying holdings of various ETFs to understand their potential growth. For the Fidelity Nasdaq Composite Index ETF (Symbol: ONEQ), the implied analyst target price stands at $87.95 per unit.

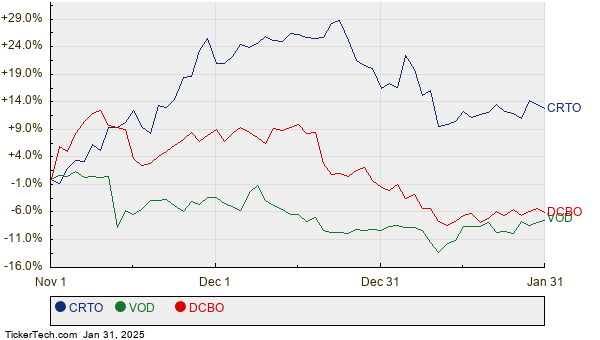

Currently, ONEQ is trading close to $77.52 per unit, indicating a projected upside of 13.45% based on the analyst targets from its holdings. Notably, three holdings within ONEQ are expected to perform well: Criteo S.A. (Symbol: CRTO), Vodafone Group plc (Symbol: VOD), and Docebo Inc (Symbol: DCBO). Despite CRTO’s recent trading price of $37.98 per share, analysts are bullish with an average target of $52.50, suggesting a significant 38.23% upside. VOD also shows promise, as its current price of $8.61 could rise by 37.34% to meet an average target of $11.82 per share. Additionally, analysts expect DCBO to achieve a target price of $58.08 per share, reflecting an anticipated 35.57% increase from its current price of $42.84. The twelve-month price history chart below visualizes the performance of CRTO, VOD, and DCBO:

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Nasdaq Composite Index ETF | ONEQ | $77.52 | $87.95 | 13.45% |

| Criteo S.A. | CRTO | $37.98 | $52.50 | 38.23% |

| Vodafone Group plc | VOD | $8.61 | $11.82 | 37.34% |

| Docebo Inc | DCBO | $42.84 | $58.08 | 35.57% |

Are analysts’ expectations reasonable, or are they too optimistic about future stock prices? Each target price sets a tone of hope about the future, but it could also lead to downward revisions if they do not reflect current realities. Investors may want to dig deeper into the recent company and industry developments to gauge the accuracy of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• BTCS market cap history

• Bassett Furniture Indus Historical Earnings

• OXLCO Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.