Analyst Upside Promises Potential for American Century U.S. Quality Growth ETF

Recent evaluations reveal that the American Century U.S. Quality Growth ETF (Symbol: QGRO) holds potential for growth according to analysts. The ETF’s weighted average implied analyst target price is $111.50 per unit.

Current Trading Price Signals Upside Potential

As of now, QGRO is trading at approximately $101.26 per unit. This pricing suggests a projected upside of 10.11% based on analysts’ targets for the ETF’s underlying holdings. Notably, three stocks within QGRO’s portfolio show significant upside compared to their respective analyst target prices: Qualys, Inc. (Symbol: QLYS), Gilead Sciences Inc (Symbol: GILD), and Paycom Software Inc (Symbol: PAYC).

Key Holdings with Promising Analyst Targets

Qualys shares are currently priced at $134.42, with an average analyst target of $149.75, indicating an 11.40% potential increase. Similarly, Gilead’s recent price of $89.14 can potentially climb by 11.10% to reach the analyst target of $99.04. Paycom is also highlighted, anticipated to rise from its current price of $199.42 to a target of $220.92, representing a 10.78% upside.

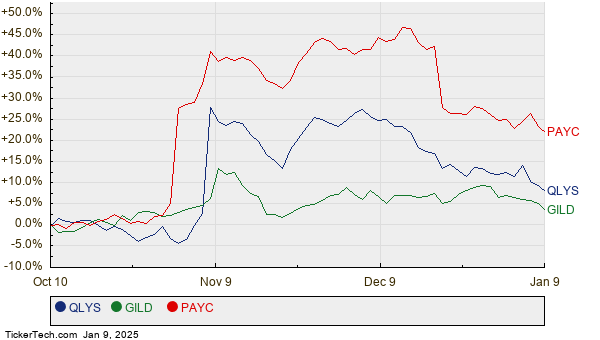

Below is a twelve-month price history chart comparing the stock performance of QLYS, GILD, and PAYC:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| American Century U.S. Quality Growth ETF | QGRO | $101.26 | $111.50 | 10.11% |

| Qualys, Inc. | QLYS | $134.42 | $149.75 | 11.40% |

| Gilead Sciences Inc | GILD | $89.14 | $99.04 | 11.10% |

| Paycom Software Inc | PAYC | $199.42 | $220.92 | 10.78% |

Questions Surrounding Analyst Optimism

As analysts set these targets, one must ponder whether their projections are realistic or overly optimistic for the mentioned stocks. Are they keeping pace with the recent developments in these companies and industries? High price targets may indicate a positive outlook, but they could also lead to downward adjustments if they don’t align with market realities. Investors are encouraged to conduct thorough research to evaluate these factors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

· MRCC Videos

· Institutional Holders of ASM

· Funds Holding ETR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.