ETF Insights: Analyzing Upside Potential in SPDR MSCI USA StrategicFactors ETF

At ETF Channel, we’ve examined the SPDR MSCI USA StrategicFactors ETF (Symbol: QUS) to understand its potential growth based on underlying holdings. By comparing the trading prices of these holdings with the average analyst 12-month target prices, we determined that QUS has an implied target price of $172.64 per unit.

Current Trading Position and Analyst Expectations

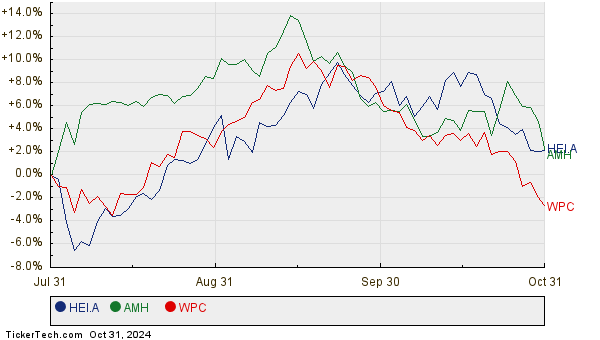

Recently, QUS traded at about $157.44 per unit. This valuation suggests a potential upside of 9.65%, as analysts anticipate that the ETF will reach its target price based on its holdings. Notably, three underlying assets—HEICO CORP CLASS A (Symbol: HEI.A), American Homes 4 Rent (Symbol: AMH), and W.P. Carey Inc (Symbol: WPC)—show significant upside potential relative to their average analyst targets.

Key Holdings with Promising Upside

HEICO CORP CLASS A, currently priced at $194.35 per share, has an average target of $230.00, indicating an upside of 18.34%. American Homes 4 Rent is priced around $36.70, with a target of $41.47, marking a possible 13.01% increase. W.P. Carey Inc, trading at $56.19, has a target price of $63.00—a 12.12% upside. Below, you can see a chart depicting the 12-month performance history for these stocks:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR MSCI USA StrategicFactors ETF | QUS | $157.44 | $172.64 | 9.65% |

| HEICO CORP CLASS A | HEI.A | $194.35 | $230.00 | 18.34% |

| American Homes 4 Rent | AMH | $36.70 | $41.47 | 13.01% |

| W.P. Carey Inc | WPC | $56.19 | $63.00 | 12.12% |

Evaluating Analyst Predictions

Investors may wonder if analysts’ target prices are realistic or overly ambitious. It’s essential to determine whether these predictions consider recent developments in the companies and the broader industry. While higher target prices can signal optimism, they might also set the stage for potential downgrades if market conditions change. This scrutiny is vital for any investor looking to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

· High Beta Stocks

· NEE Options Chain

· M Dividend Growth Rate

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.