ALPS Sector Dividend Dogs ETF Target Price Analysis and Outlook

At ETF Channel, we have examined the holdings of the ALPS Sector Dividend Dogs ETF (Symbol: SDOG) by comparing the trading prices of each underlying asset against the average analyst 12-month forward target price. Our analysis indicates that the implied analyst target price for SDOG is $62.15 per unit.

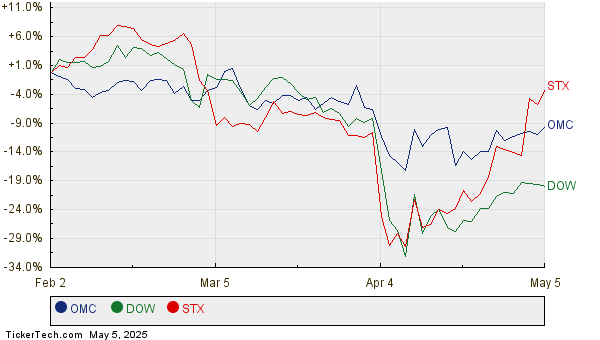

Currently, with SDOG trading at approximately $55.58 per unit, this suggests analysts foresee an upside of 11.81% based on the average targets for the ETF’s underlying holdings. Notably, three components within SDOG are expected to see significant gains: Omnicom Group, Inc. (Symbol: OMC), Dow Inc. (Symbol: DOW), and Seagate Technology Holdings PLC (Symbol: STX). Although OMC is trading at $77.07 per share, analysts have set an average target of $97.78 per share, marking a potential upside of 26.87%. Similarly, DOW, currently at $30.42, has a target of $36.95, translating to an upside of 21.46%. Lastly, STX is expected to reach a target of $109.29 per share, indicating a possible increase of 17.43% from its current trading price of $93.07. Below is a chart showing the 12-month price history for OMC, DOW, and STX:

In total, OMC, DOW, and STX constitute 6.03% of the ALPS Sector Dividend Dogs ETF. The following table summarizes the current analyst target prices for these holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ALPS Sector Dividend Dogs ETF | SDOG | $55.58 | $62.15 | 11.81% |

| Omnicom Group, Inc. | OMC | $77.07 | $97.78 | 26.87% |

| Dow Inc | DOW | $30.42 | $36.95 | 21.46% |

| Seagate Technology Holdings PLC | STX | $93.07 | $109.29 | 17.43% |

This analysis raises questions about the accuracy of these targets. Are analysts justified in their price expectations, or are they overly optimistic regarding where these stocks will trade in the next 12 months? A high price target compared to a stock’s current trading price can indicate optimism yet may also lead to downgrades if the targets do not reflect recent developments in the industry. Investors should conduct further research to evaluate the validity of these analyst projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• JPXN market cap history

• Institutional Holders of ERA

• Funds Holding LOR

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.