Analysts See Upside for Invesco’s Low Volatility ETF

At ETF Channel, we examined the underlying holdings of various ETFs. We compared the trading price of each holding with the average analyst 12-month forward target price. This analysis led us to compute the weighted average implied analyst target price for the Invesco S&P 500 Low Volatility ETF (Symbol: SPLV), which stands at $80.39 per unit.

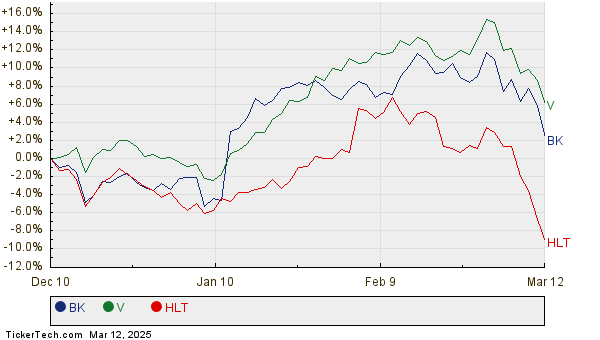

Currently, SPLV is trading at approximately $72.85 per unit. This indicates analysts project a 10.35% upside for the ETF, as they anticipate the average targets of the underlying holdings. Noteworthy are three holdings within SPLV showing significant upside potential: Bank of New York Mellon Corp (Symbol: BK), Visa Inc (Symbol: V), and Hilton Worldwide Holdings Inc (Symbol: HLT). For instance, BK recently traded at $81.05 per share, yet its average analyst target is 15.67% higher at $93.75 per share. Similarly, Visa, with a current price of $332.14, has an analyst target of $382.76 per share, suggesting a 15.24% upside. Lastly, Hilton is expected to reach a target of $266.50, which is 14.95% above its recent price of $231.83. Below, you can see a twelve-month price history chart comparing the stock performance of BK, V, and HLT:

Here’s a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 500 Low Volatility ETF | SPLV | $72.85 | $80.39 | 10.35% |

| Bank of New York Mellon Corp | BK | $81.05 | $93.75 | 15.67% |

| Visa Inc | V | $332.14 | $382.76 | 15.24% |

| Hilton Worldwide Holdings Inc | HLT | $231.83 | $266.50 | 14.95% |

Are analysts justified in these targets, or are they overly optimistic about future stock prices? It’s essential for investors to analyze whether these targets reflect realistic assessments or are antiquated figures. A high target relative to a stock’s current trading price might signal optimism, but it can also precede downward target adjustments if the expectations do not align with recent company and industry trends. Such considerations warrant further research from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SMI Historical Stock Prices

• IVOG Options Chain

• Funds Holding PBR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.