Market Insights: ETF Analysis Reveals Potential Gains

In our latest analysis at ETF Channel, we explored the underlying holdings of the ETFs in our coverage universe. By comparing each holding’s trading price with the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the Strive 500 ETF (Symbol: STRV), which stands at $43.04 per unit.

STRV Shows Upside Potential

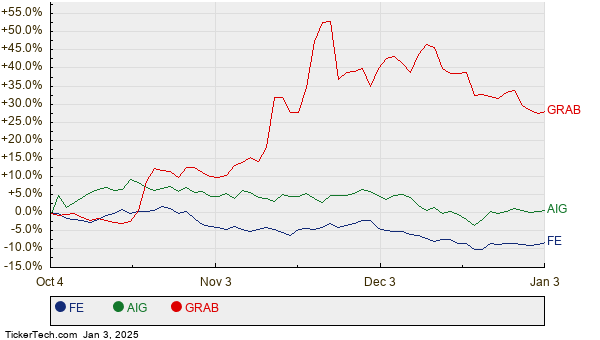

Currently trading at approximately $37.73 per unit, STRV exhibits a projected upside of 14.08% based on analysts’ targets for its underlying holdings. Notable stocks contributing to this optimism include FirstEnergy Corp (Symbol: FE), American International Group Inc (Symbol: AIG), and Grab Holdings Ltd (Symbol: GRAB). For instance, FE is trading at $39.91 per share, with analysts forecasting an 18.23% increase to a target of $47.19 per share. AIG, priced at $72.98, has a potential upside of 16.32% to reach an average target of $84.89. Similarly, GRAB’s current price of $4.74 suggests a 15.70% rise towards its target of $5.48, as predicted by analysts.

Current Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Strive 500 ETF | STRV | $37.73 | $43.04 | 14.08% |

| FirstEnergy Corp | FE | $39.91 | $47.19 | 18.23% |

| American International Group Inc | AIG | $72.98 | $84.89 | 16.32% |

| Grab Holdings Ltd | GRAB | $4.74 | $5.48 | 15.70% |

Investor Considerations

As investors assess these target prices, a key question remains: Are analysts’ forecasts realistic, or are they overly optimistic? Justifications for these targets hinge on recent industry and company developments. A high target relative to a stock’s current price may signal optimism, yet it can also lead to price target downgrades if those estimates don’t align with the market’s evolving perspectives. Investors are encouraged to conduct their own research to navigate these insights effectively.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Historical Earnings

• Funds Holding CTSH

• General Electric RSI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.