Analysts See Upside Potential for Industrial Select Sector ETF

In our latest analysis at ETF Channel, we evaluated the underlying holdings of various ETFs. By comparing the trading price of each holding with the average 12-month forward target price set by analysts, we calculated the weighted average implied target price for the ETFs. For the Industrial Select Sector SPDR Fund ETF (Symbol: XLI), the implied analyst target price is $153.63 per unit.

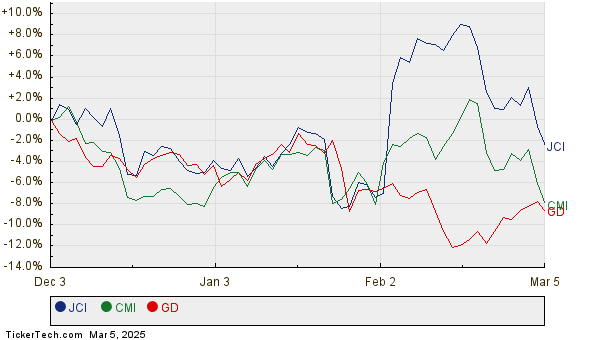

Currently, XLI trades at around $131.77 per unit. This indicates that analysts project a 16.59% upside for the ETF based on the average targets of its underlying holdings. Notably, three of XLI’s holdings show significant upside potential: Johnson Controls International plc (Symbol: JCI), Cummins, Inc. (Symbol: CMI), and General Dynamics Corp. (Symbol: GD). JCI’s recent trading price is $80.90 per share, but analysts target $95.00 per share, reflecting a potential upside of 17.43%. Similarly, CMI’s recent share price of $347.32 presents a 17.37% upside to the average target of $407.64. Analysts also anticipate GD to reach $294.20 per share, which is 17.30% above its current price of $250.80. Below is a chart depicting the twelve-month price history for JCI, CMI, and GD:

Here’s a summary table showcasing the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Industrial Select Sector SPDR Fund ETF | XLI | $131.77 | $153.63 | 16.59% |

| Johnson Controls International plc | JCI | $80.90 | $95.00 | 17.43% |

| Cummins, Inc. | CMI | $347.32 | $407.64 | 17.37% |

| General Dynamics Corp | GD | $250.80 | $294.20 | 17.30% |

These projections raise important questions: Are analysts justified in their targets, or are they overly optimistic about these stocks’ future performance? It’s critical to consider whether analysts base their forecasts on current company and industry developments. While high price targets might suggest optimism, they could also precede potential downgrades if unrealistic. Investors should conduct further research to navigate these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

– George Soros Stock Picks

– NVIV Videos

– AGT Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.