Nvidia’s Remarkable Journey: A Look at Its AI Dominance and Future Potential

In the past two years, Nvidia (NASDAQ: NVDA) has proven to be a lucrative investment, with shares skyrocketing 736%. This surge is largely attributed to its pivotal role in the growth of artificial intelligence (AI).

Strong Financial Performance Paves the Way for Future Growth

Nvidia’s impressive returns are backed by rapid increases in revenue and earnings, primarily due to its strong position in the AI chip market. Management’s recent comments during the earnings call suggest that the company is set to continue this upward trajectory over the next three years.

On November 20, Nvidia released its fiscal 2025 third-quarter results, reporting record revenue of $35.1 billion. This reflects a remarkable 94% increase year-over-year, largely driven by a 112% jump in data center revenue, reaching $30.8 billion.

The company had initially expected fiscal Q3 revenue to be around $32.5 billion, but it exceeded that estimate by ramping up production of its next-generation Blackwell processors. Nvidia reports “staggering demand” for these AI chips, prompting the need to “race to scale supply.”

The robust demand for the Blackwell processors is not without reason. Recent tests show that Nvidia’s latest AI processors offer a 2.2x performance boost over their predecessors. Additionally, these enhancements have led to lower computing costs. As CFO Colette Kress noted:

The 64 Blackwell GPUs are required to run the GPT-3 benchmark compared to 256 H100s, resulting in a 4x reduction in cost.

To capitalize on this demand, Nvidia plans to increase Blackwell processor output, even if it sacrifices some margins in the short term. The company anticipates a non-GAAP gross margin of 73.5% this quarter, down from 76.7% a year ago. However, Kress expects margins to recover once production stabilizes.

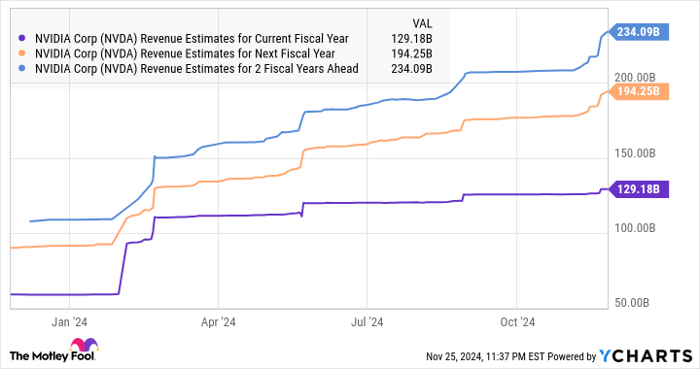

Furthermore, Japanese investment bank Mizuho recently increased Nvidia’s GPU sales estimate for 2025 by 10% to 30 million units, reflecting the growing demand for these chips across gaming, data centers, and AI. This trend supports strong growth projections for Nvidia in fiscal years 2025 and 2026.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

Nvidia’s Product Roadmap: A Catalyst for Future Growth

Nvidia’s stronghold in the GPU market stems from its technological edge over competitors. Companies like AMD continue to play catch-up as Nvidia captures a significant portion of the AI chip market. An aggressive product roadmap indicates the potential for sustained success in this lucrative sector.

Nvidia’s Blackwell processors are set to be replaced by chips utilizing the Rubin architecture in the first half of 2026. Analysts anticipate that these Rubin chips will be produced using a 3-nanometer (nm) process node from Taiwan Semiconductor Manufacturing, a step up from the Blackwell’s 4NP process.

A smaller process node allows Nvidia to fit more transistors in a smaller space, which can enhance computing power while lowering energy consumption. This innovation is likely to help Nvidia maintain its technological lead over its competitors, ensuring continued pricing power in the AI chip segment.

With market predictions estimating that AI chips will generate $500 billion in revenue by 2028, Nvidia’s dominance is expected to translate into significant revenue and profit growth. Analysts have thus upgraded their forecasts for the company for the present and future fiscal years.

Similar optimistic projections extend to fiscal 2027, aligning with most of its calendar year 2026.

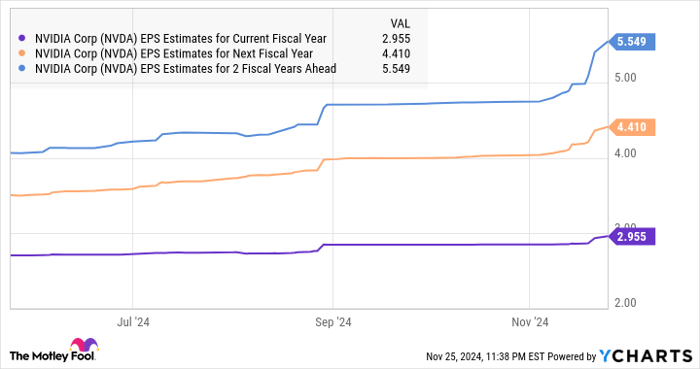

NVDA EPS Estimates for Current Fiscal Year data by YCharts

Analysts predict Nvidia will achieve earnings of $5.55 per share in fiscal 2027. If the stock trades at a forward earnings multiple of 40.8 (in line with its five-year average), this could lead to a stock price of $226—representing a 67% increase from current levels.

Currently, Nvidia is trading at 36 times forward earnings, making this an appealing buying opportunity for investors, especially as the company could see even greater gains if rewarded with a higher valuation in the future.

Is Investing $1,000 in Nvidia a Smart Move Right Now?

Before making any investment decisions regarding Nvidia, it’s crucial to consider the following:

The Motley Fool Stock Advisor analyst team has recently identified the 10 best stocks for investors to consider, and Nvidia is not on that list. The stocks that made the cut have the potential to deliver significant returns in the coming years.

If you had invested $1,000 in Nvidia on April 15, 2005, when it made the list, it would now be worth $829,378!

Stock Advisor offers a straightforward investment strategy, including guidance on building a portfolio and monthly stock picks. Since 2002, the service has outperformed the S&P 500 by over four times.

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Harsh Chauhan does not have a position in any stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. For more, see the Motley Fool’s disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.