Prologis Inc. (NYSE: PLD) reported earnings on July 16, revealing a revenue of $2.03 billion and earnings per share (EPS) of $1.46, slightly above forecasts. Following the report, the stock rose by 4% but dropped 1.3% to below its pre-earnings closing price by midday July 17.

The company is focusing on data center land, offering nearly 1.2 billion square feet of industrial space near metropolitan areas with constrained power grids. Prologis reaffirmed its full-year funds from operations (FFO) guidance of $5.27 to $5.31 per share, supported by net debt to adjusted EBITDA of 4.1x. Analysts at Wells Fargo gave the stock an Overweight rating with a price target of $137, which is higher than the consensus target of $120.47.

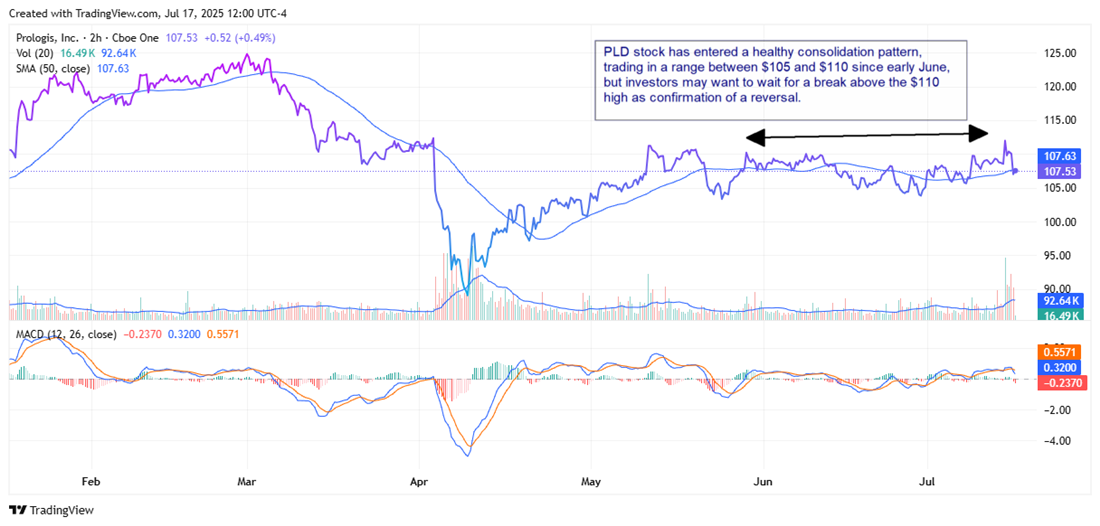

Historically, PLD has traded at 27x earnings, indicating it is currently trading at a discount. After reaching a 52-week low in April, the stock has consolidated between $105 and $110 since early June, with bullish momentum suggested by the MACD indicator.