Rising Tides for IPOs: Positive Signals from Stockholm and the U.S.

A new update from our Nasdaq Stockholm IPO Pulse offers insights into the potential IPO climate in both Stockholm and the U.S. as we approach 2025.

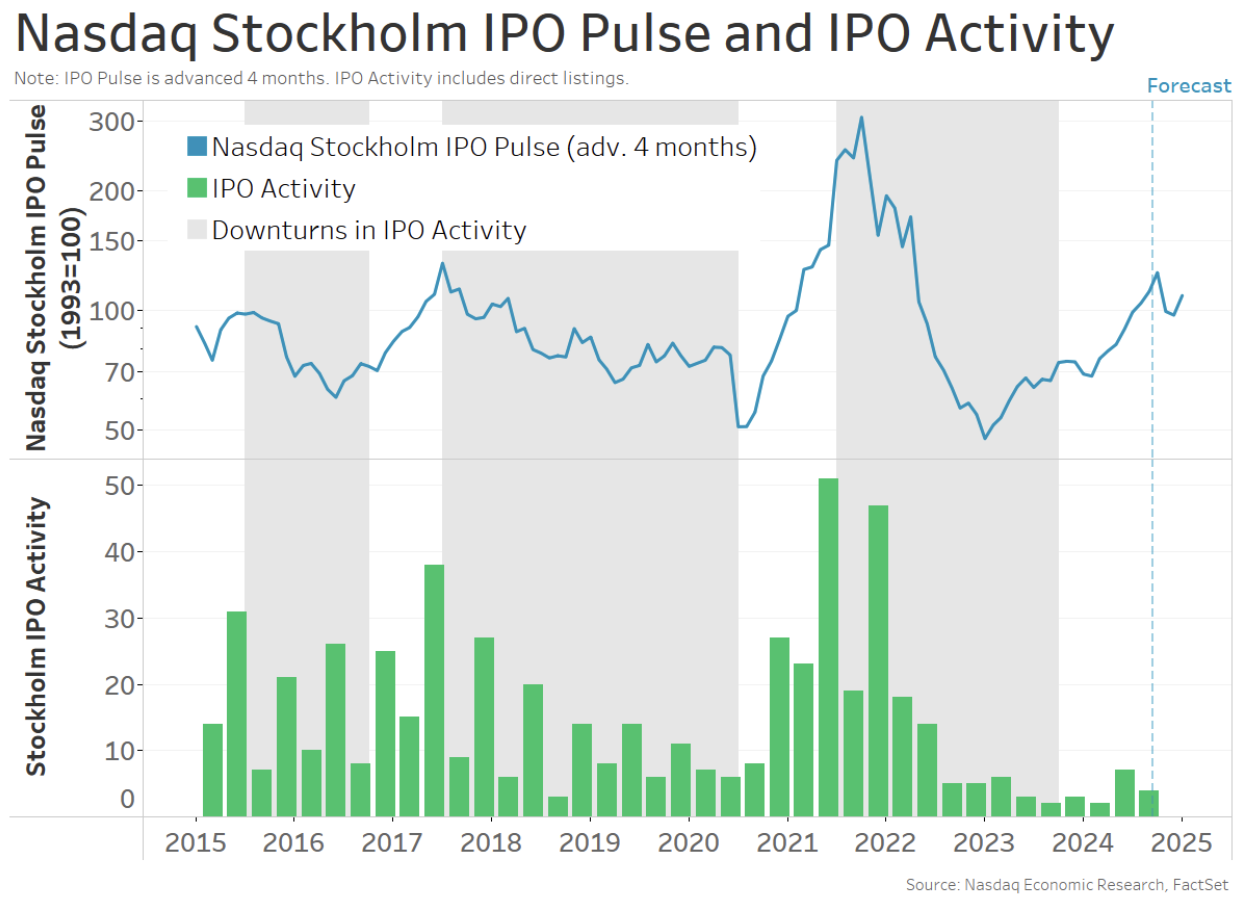

Stockholm’s IPO Activity Nears Highs

In June, the Nasdaq Stockholm IPO Pulse reached a 2½-year peak, signaling an upward trend in IPO activity. This trend continued, as IPO activity hit a two-year high in the second quarter.

In the third quarter, the IPO Pulse initially dipped before rebounding in September, now approaching June’s high mark. Although Q3 showed a slow down, it was affected by seasonal trends, as many Swedes take vacations during the warm summer months.

Despite the dip, Q3 recorded the second highest number of IPOs in the last six quarters.

Chart 1: Continued Increase in IPO Activity for Stockholm

Given the Nasdaq Stockholm IPO Pulse’s position close to its recent high, momentum in IPO activity is expected to persist into early 2025.

U.S. IPO Pulse Also Shows Strength

Similar trends are visible in the U.S. with the Nasdaq IPO Pulse. In September, it slightly declined for the second month in a row, reaching a three-month low but remaining close to July’s three-year high.

Likewise, IPO activity in the U.S. held steady in Q3, maintaining the levels seen in Q2, which were the highest in 2½ years. Thus far in 2024, there have been IPOs for 126 operating companies and 34 SPACs.

Chart 2: Sustained IPO Activity in the U.S.

With the Nasdaq IPO Pulse nearing a three-year peak, U.S. IPO activity is also likely to remain strong moving into early next year.

Global Rate Cuts Boosting IPO Activity

Interestingly, the positive trend in the Nasdaq IPO Pulse occurred despite ongoing rate hikes by the Federal Reserve. However, the Fed is now pivoting to rate cuts after 14 months at their highest point, which should encourage more IPO activity.

Along with the Fed, several major central banks, including Sweden’s Riksbank and the European Central Bank, have started to cut rates this year as well.

The Fed’s projections indicate rates might drop from the current 5% to around 3% by the end of 2026. Market expectations suggest fed funds rates may reach 3.4% by late next year before stabilizing.

Chart 3: Expected Global Rate Decreases

With lower rates anticipated in the U.K. and Eurozone as well, the trend could further support the IPO landscape globally.

Impact of High Rates on IPO Candidates

High interest rates previously hindered IPOs for a couple of reasons. First, they negatively impact valuations, raising the cost of borrowing and making it tougher to achieve future earnings. This leads to fewer IPOs due to less appealing valuations.

Additionally, higher borrowing costs directly affect margins, particularly for smaller firms, which often carry a significant amount of floating-rate debt.

Data reveals that approximately 40% of small-cap debt is floating rate, unlike only 7% for large caps. Consequently, the Fed’s rate hikes have doubled the ratio of interest expenses to earnings for U.S. small caps, affecting their financial health.

Chart 4: How Higher Rates Damage Margins

As rates decline, it may become easier for small companies to increase profits and improve their valuations, removing two significant obstacles to IPO success. Additionally, once the upcoming election concludes, another temporary challenge to IPO activity may be lifted.

Positive Outlook for IPOs into 2025

With these headwinds poised to diminish, and both IPO Pulses showing strength, the upward trend in IPO activity in both the U.S. and Stockholm is likely to continue into early next year.

Michael Normyle, U.S. Economist at Nasdaq, contributed to this article.