Key Points

-

Taiwan Semiconductor Manufacturing Company (TSMC) has captured 72% of the contract semiconductor manufacturing market, significantly increasing its market share as demand for advanced chip designs grows.

-

As of Q3 2024, TSMC implemented price hikes of 3% to 10% across its advanced nodes (7nm, 5nm, and 3nm chips), which accounted for nearly 75% of its revenue.

-

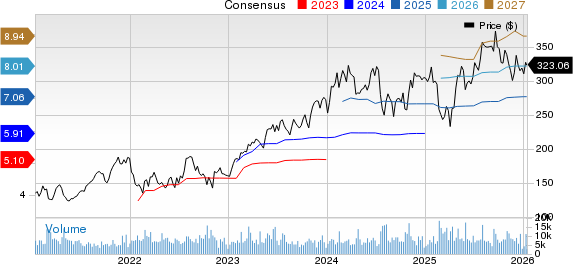

Analysts project TSMC’s revenue to rise by 23% this year, leading to a 26% increase in earnings per share; its current forward price-to-earnings ratio stands at 24.5, significantly lower than Nvidia’s 39.4 and Broadcom’s 34.

Heading into 2026, TSMC is positioned to outperform both Nvidia and Broadcom, backed by multiyear pricing strategies and strong demand for its cutting-edge technology. The company is ramping up production of its 2nm node, further solidifying its status as a leading contract manufacturer in the semiconductor industry.