CoreWeave’s IPO and Market Performance

CoreWeave (NASDAQ: CRWV), an AI infrastructure specialist, has emerged as the largest initial public offering (IPO) of 2023. However, the offering was undersubscribed and priced below expectations, with Nvidia stepping in to buy a significant portion to stabilize it. On its debut, CoreWeave’s stock opened at $40 but closed unchanged, highlighting weak initial investor interest.

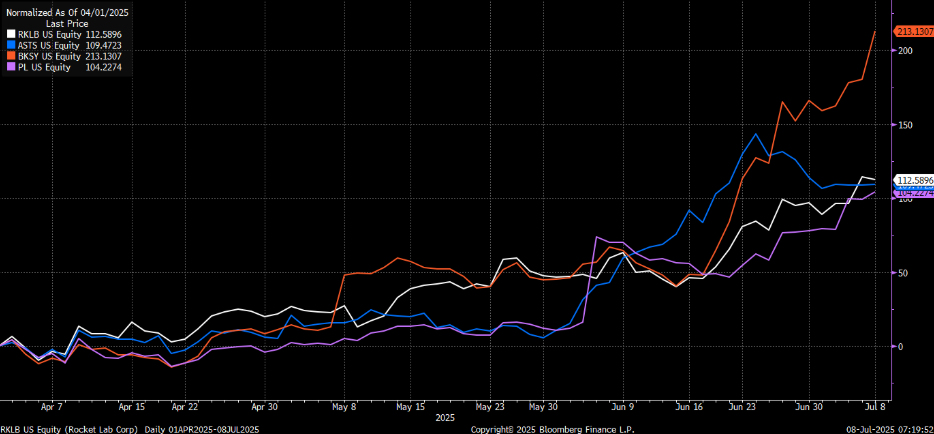

Since its launch in late March, CoreWeave’s stock has seen considerable volatility, surging to a high of $188 before a recent pullback, currently trading over three times its IPO price. The company reported a staggering 420% revenue increase to $981.6 million in the first quarter, driven by growing demand for AI computing, despite the challenges of being deeply unprofitable and reliant on key partnerships, particularly with Microsoft (which accounts for 62% of its projected revenue for 2024).

CoreWeave, originally an Ethereum miner, has pivoted to providing cloud computing infrastructure for generative AI applications. Its high-profile partnerships include OpenAI, which invested $350 million in March, and Nvidia, which owns around 24.2 million shares valued at approximately $3 billion.