New Call Options for Diodes, Inc. Offer Potential Gains

Investors in Diodes, Inc. (Symbol: DIOD) recently saw new options become available for trading, specifically for contracts expiring on May 16th. The YieldBoost formula from Stock Options Channel has examined the DIOD options chain and highlighted a specific call contract of interest.

Details of the Call Contract

The featured call contract is priced at a $35.00 strike price, with a current bid of $1.65. If an investor purchases shares of DIOD at the current market price of $34.69 per share and sells a call contract as a covered call, they commit to selling the stock at $35.00. By doing so, the investor stands to gain a total return of 5.65%, excluding any dividends, if the stock is called away by the May 16th expiration, before accounting for broker commissions.

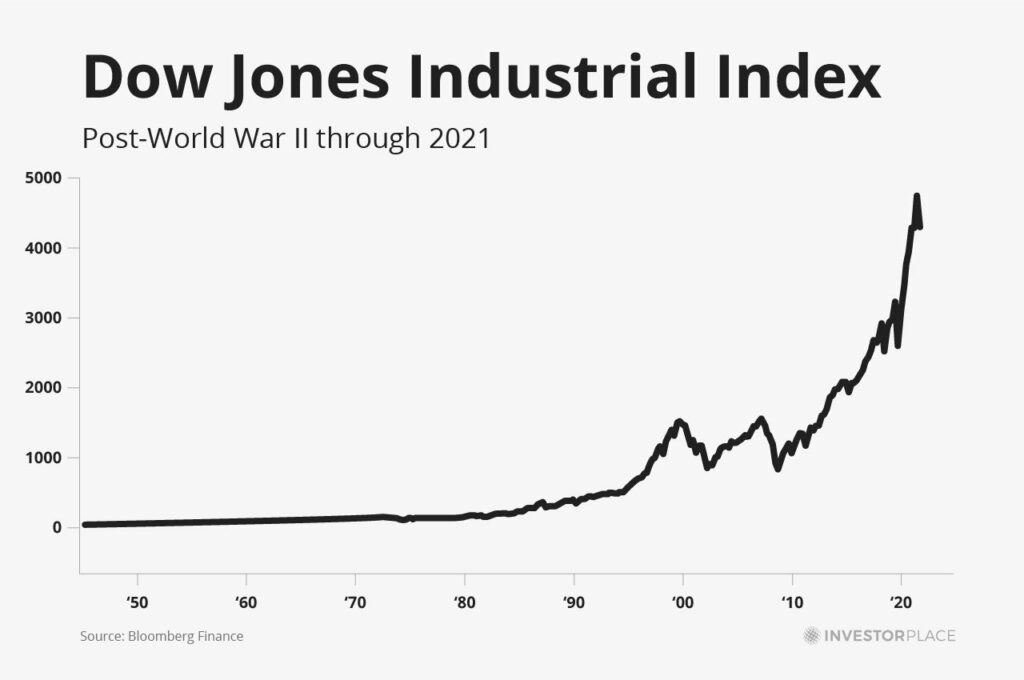

Investors must consider potential gains alongside risks. If DIOD shares increase significantly in value, they may miss out on additional upside. This emphasizes the importance of analyzing Diodes, Inc.’s trailing twelve-month trading history along with its business fundamentals. The chart below illustrates DIOD’s performance over the past year, marking the $35.00 strike in red:

Understanding the Strike Price and Market Implications

The $35.00 strike price represents approximately a 1% premium over the current trading price, meaning it is out-of-the-money by that percentage. Consequently, the covered call could expire worthless, allowing the investor to retain both their shares and the premium earned. Current analytical data suggests a 45% chance that this outcome will occur. Stock Options Channel tracks these odds and publishes updates to show changes over time, along with a chart of the option contract’s trading history.

Should the call contract expire worthless, the premium would provide a 4.76% increase in returns for the investor, equating to an annualized return of 41.34%, a figure we refer to as the YieldBoost.

Volatility Considerations

The implied volatility for the above call contract stands at 66%. On the other hand, we calculate the actual trailing twelve-month volatility—using the last 251 trading day closing values and the current price of $34.69—to be 49%. For more options contract insights, including additional put and call ideas, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

also see:

- BDC Baby Bonds and Preferreds

- AMRC shares outstanding history

- Top Ten Hedge Funds Holding BKYF

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.