Key Points

As of January 2026, Meta Platforms (NASDAQ: META) has an impressive daily user base of 3.54 billion, reflecting an 8% year-over-year increase. The company is experiencing strong growth with its AI-driven Ray-Ban Display glasses, contributing to significant revenue generation.

Micron Technology (NASDAQ: MU) is positioned as a bargain with a forward price-to-earnings ratio of 10.8 and a PEG ratio of 0.6. The company expects a 20% growth in memory shipments for 2026, particularly in high-bandwidth memory (HBM), which is fully allocated for the year.

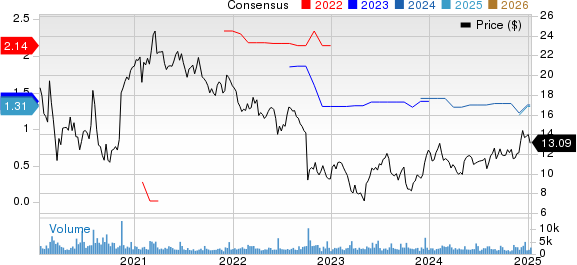

Mirum Pharmaceuticals (NASDAQ: MIRM), with a market cap of $4.5 billion, reported a 56% year-over-year increase in sales of its liver disease drug, Livmarli, reaching $92.2 million in Q3 2025. The company anticipates results from key clinical studies and a pending acquisition that could enhance its growth prospects in 2026.