Prosperity Bancshares, Inc. has solidified its foothold in the financial landscape with the recent conclusion of its merger with Lone Star State Bancshares, Inc. The acquisition, unveiled in October 2022, sets the stage for PB’s expansion in West Texas, propelling the total banking centers count to 49 in the region.

The meticulous deal structure involved the issuance of 2.38 million shares coupled with a $64.1 million cash payment. With all regulatory boxes checked last month and Lone Star shareholders’ nod secured in March 2023, the path was clear for this financial matrimony to flourish.

Alan Lackey, the visionary CEO of Lone Star, will pioneer Prosperity Bank’s West Texas Area team, with Melisa Roberts, the sharp-witted chief lending officer of Lone Star, by his side as the newly-appointed president and vice president, respectively. Mike Marshall, the esteemed chairman of the West Texas division, will lead the trio to new banking horizons.

Strengthening the Financial Tapestry

Lone Star’s distinguished network encompasses five banking offices strategically positioned in West Texas, with branches in Brownfield, Midland, Odessa, and Big Spring. As of Dec 31, 2023, Lone Star boasted impressive statistics – total assets of $1.37 billion, total loans of $1.08 billion, and total deposits of $1.21 billion.

The Lone Star brand continues to stand strong, retaining its identity until operational integration on Oct 28, 2024. Once the integration is complete, Lone Star customers will have seamless access to PB’s extensive network of 288 banking centers, simplifying banking endeavors.

Strategic Growth Initiatives

This strategic acquisition not only amplifies Prosperity Bancshares’ regional footprint but also ushers in diversified revenue streams and bolsters the asset base. With a rich history of more than 30 opportunistic acquisitions since 1998, Prosperity Bancshares stays true to its growth trajectory.

Recently, in May 2023, the company finalized the acquisition of First Bancshares of Texas, Inc., a move that further solidified its presence in Texas and positioned the company for exponential market growth.

With a robust capital base, a knack for M&A ventures, and fortified relationships, Prosperity Bancshares is primed for augmented success through strategic acquisitions.

Industry Insights & Acquisitions

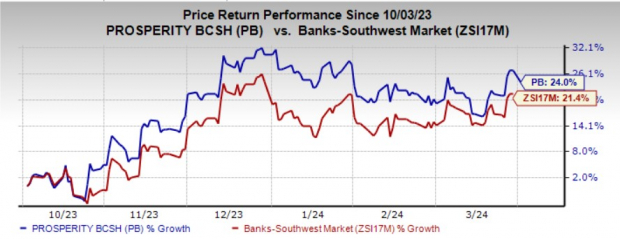

Over the past half-year, Prosperity Bancshares’ shares have soared by 24%, eclipsing the industry’s growth at 21.4% over the same period.

Image Source: Zacks Investment Research

Shifting focus to industry trends, various financial services firms have engaged in notable acquisitions. Last month, Royal Bank of Canada successfully concluded the acquisition of HSBC Canada, a transformative move valued at C$13.5 billion.

The seamless integration with HSBC Canada expands RY’s global banking expertise, creating a dynamic platform to connect Canadians to the worldwide economic fabric.

In a parallel narrative, Synchrony Financial triumphantly wrapped up its acquisition of Ally Lending from Ally Financial Inc., injecting $2.2 billion of loan receivables into its arsenal. This strategic move bolsters SYF’s multi-product strategy, enhancing its ability to offer unique installment options to merchants and contractors.

With overarching industry implications in sight, prosperous synergies emerge, driving these financial juggernauts towards newfound growth trajectories in the banking and wealth management sphere.