Proto Labs PRLB is scheduled to report first-quarter 2024 results on May 3, before the opening bell.

Q4 Results

The company delivered year-over-year improvements in both top and bottom lines in the fourth quarter of 2023. It also beat the Zacks Consensus Estimate for revenues and earnings. Notably, Proto Labs has surpassed earnings estimates in the trailing four quarters, the average surprise being 42.4%.

Q1 Estimates

The Zacks Consensus Estimate for PRLB’s first-quarter revenues is pegged at $123.8 million, indicating a decline of 1.6% from the year-ago reported figure. The consensus estimate for earnings is pegged at 30 cents per share, suggesting in-line results compared with the year-ago quarter. The estimate for quarterly earnings has been unchanged in the past 60 days.

Proto Labs, Inc. Price and EPS Surprise

Proto Labs, Inc. price-eps-surprise | Proto Labs, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Proto Labs this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that is not the case here, as you can see below.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: PRLB has an Earnings ESP of 0.00%.

Zacks Rank: The company currently carries a Zacks Rank of 3.

Key Factors to Note

In the fourth quarter of 2023, the company reported an 8.2% increase in revenues to $125 million. With this performance, the company’s revenues for 2023 attained a record of $503.9 million. Also, this was the first time in its 25-year history that the company’s revenues crossed the $500 million threshold. Along with record revenues for the year, Proto Labs significantly improved profitability in both the digital factory and the digital network. The company also reported $73 million in cash from operations, which was above industry average.

Revenues generated from Protolabs Network were $82.6 million in 2023, representing growth of 70.4% from the prior year. Protolabs served 53,464 customer contacts during the year , which represented one of the largest customer bases in the industry. This momentum is expected to contribute to the company’s 2024 results as well.

For the first quarter of 2024, the company anticipates revenues in the range of $120 million to $128 million compared with sales of $125.86 million in the first quarter of 2023. The company’s forecast indicates a slower beginning to 2024, attributed to lower order levels in December 2023 and early January 2024 compared with historical periods. Nevertheless, we expect the order levels to have witnessed an uptick, reflecting the expansion in manufacturing activity observed toward the quarter’s end.

PRLB expects adjusted earnings per share between 26 cents and 34 cents. The company had reported adjusted earnings per share of 30 cents in the year-ago quarter. First-quarter margins are expected to have been impacted by an unfavorable mix of revenues due to higher sales in the network, as well as deleveraging of fixed costs from lower volumes in the digital factory. The company’s ongoing efforts to improve efficiency are expected to have dented some of the impact.

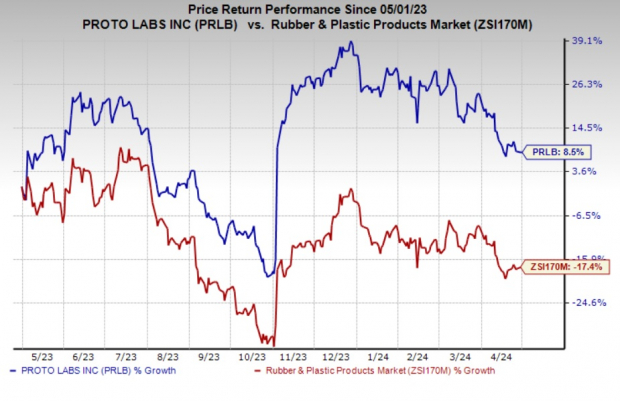

Price Performance

Proto Lab’s shares have gained 8.5% in the past year against the industry’s 17.4% decline.

Image Source: Zacks Investment Research

Stocks That Warrant a Look

Here are some Industrial Products stocks with the right combination of elements to post an earnings beat in their upcoming releases.

Axon Enterprise, Inc. AXON has an Earnings ESP of +5.97% and a Zacks Rank of 1, at present.

The company is scheduled to release first-quarter 2024 results on May 6. The Zacks Consensus Estimate for AXON’s earnings is pegged at 97 cents per share, suggesting year-over-year growth of 10%.

Axon’s earnings have surpassed the consensus estimate in each of the preceding four quarters, the average beat being 58.7%.

Ingersoll Rand Inc. IR, scheduled to release its first-quarter 2024 on May 2, has an Earnings ESP of +1.82% and a Zacks Rank of 2, at present.

The Zacks Consensus Estimate for Ingersoll Rand’s earnings is pegged at 69 cents per share, indicating year-over-year growth of 6%. It has a trailing four-quarter average surprise of 15.9%.

Chart Industries GTLS, scheduled to release its first-quarter 2024 on May 3, currently has an Earnings ESP of +9.86% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Chart Industries’ earnings is pegged at $1.88 per share, indicating 33.3% year-over-year growth. GTLS has a trailing four-quarter average surprise of 75.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s an American AI company that’s riding low right now, but it has rounded up clients like BMW, GE, Dell Computer, and Bosch. It has prospects for not just doubling but quadrupling in the year to come. Of course, all our picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Proto Labs, Inc. (PRLB) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.