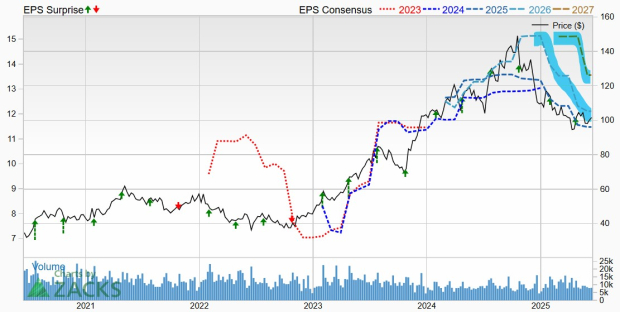

PulteGroup, Inc. (PHM) faces a challenging operational environment, with projected adjusted earnings down 22% year-over-year in 2025 and 4% lower sales. The guidance provided during Q1 results in April suggested consumers struggle with high home prices and monthly payments, generating a Zacks Rank #5 (Strong Sell) due to downbeat revisions.

Operating in 24 states and over 45 major markets, PulteGroup has delivered over 800,000 homes, with its brands catering to a diverse clientele: 35% to first-time buyers, 39% to move-up buyers, and 26% to active-adult buyers. However, the company’s stock has declined roughly 30% from its 2024 highs, indicating significant challenges ahead.

Despite long-term housing demand benefits from a structural shortage, rising interest rates and high prices are causing a slowdown. CEO Ryan Marshall noted the need to adapt to short-term consumer demand impacts amid economic uncertainties.