Retail Sector Earnings Reports: Key Insights and Trends

The retail sector remains in the spotlight this week, with major companies like Target (TGT), Best Buy (BBY), Costco (COST), and Macy’s (M) set to release their earnings results. Early indicators show steady consumer spending, reflecting a consistent trend observed in previous quarters. Although recent consumer confidence surveys indicate a slight decline, longer-term trends remain positive, bolstered by a strong labor market and rising wages.

In the past few quarters, inflation has impacted consumer spending, particularly among lower-income households. This situation has driven most consumers to prioritize essential purchases, leading to subdued spending on durable and discretionary goods. We anticipate further evidence of this trend in the upcoming reports from Target and Best Buy.

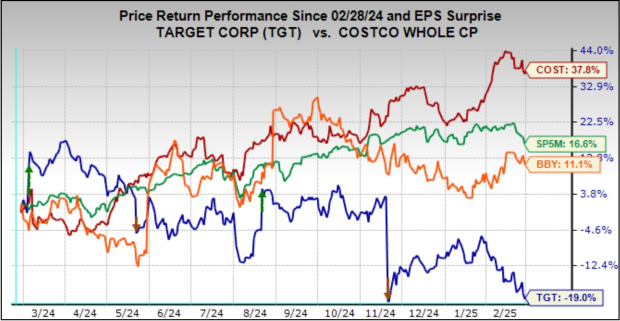

The chart below illustrates the one-year performance of Target (blue line; down -19%), Best Buy (orange line; up +11.1%), Costco (red line; up +37.8%), and the S&P 500 index (green line; up +16.6%).

Image Source: Zacks Investment Research

As evident from the chart, Target’s shares fell significantly after its last earnings report on November 20th, where it failed to meet all estimates, including comparable sales metrics. Although management noted positive momentum early in the quarter, demand weakened in January and likely continued to decline into February.

Analysts expect Target to announce earnings of $2.24 per share on $30.77 billion in revenue, reflecting year-over-year declines of -24.8% and -3.6%, respectively. Projections had seen slight increases after the mid-January update but have since remained stable. Comparable store sales are forecasted to grow by +1.2%, which is modest compared to last quarter’s growth of only +0.3% against an expectation of +1.53%.

With Target trading near its 52-week lows, the sentiment appears weak, potentially minimizing further downside risks. Given its history of volatility around quarterly results, minimal positive news following Tuesday’s earnings release could drive the stock higher.

Best Buy is also set to report, with expectations for earnings per share (EPS) of $2.39 on revenues of $13.65 billion. This translates to annual declines of -12.1% and -6.8%, respectively. Analysts project a same-store sales decline of -1.54%, following a -2.9% drop in the prior quarter ending November 26th, 2022. The stock experienced a downturn after November’s earnings release due to a significant miss in comparable sales.

There is some hope for sequential improvement this quarter, as holiday promotions likely boosted sales. However, the overall revenue outlook remains bleak, with projected revenues for the fiscal year 2024 (ending January 2025) at $41.2 billion, reflecting a -5.1% decrease from the previous year. This follows a downward trend from COVID-era peaks of $51.76 billion in fiscal 2022 and subsequent revenues of $46.3 billion in 2022 and $43.5 billion in 2023.

Looking ahead, there is cautious optimism that revenues will stabilize, with the current Zacks Consensus estimate suggesting a slight increase to $41.76 billion, a +1.3% rise. Although demand for most appliances and durables remains weak, the outlook for computers and smartphones is improving, influenced by new AI-driven products and ongoing replacements. This trend appears to be reflected in the company’s performance.

Costco stands out as a leader in the sector, especially among higher-income customers drawn to its value offerings. This was reaffirmed by January’s same-store sales data showing a company-wide increase of +7.5%, which is composed of a +7.1% rise in traffic and +0.4% in average ticket prices.

Costco is expected to report earnings of $4.09 per share on $63.2 billion in revenue, marking increases of +10.2% and +63.2%, respectively. Earnings estimates have improved slightly, with the current EPS expectation rising from $4.06 a month ago and $3.97 three months ago. For the current fiscal year, which ends in August 2025, Costco’s earnings and revenues are projected to rise by +11.9% and +7.4%, respectively. The company is positioned to maintain growth momentum, supported by mid-single-digit comparable growth and high-single-digit membership fee income growth.

Retail Sector 2024 Q4 Earnings Overview

In the ongoing retail sector earnings season, 26 of the 33 retailers in the S&P 500 index have reported their results. The Zacks Retail sector distinctly categorizes Target, Best Buy, and various other retailers, including online players like Amazon (AMZN) and restaurant operators.

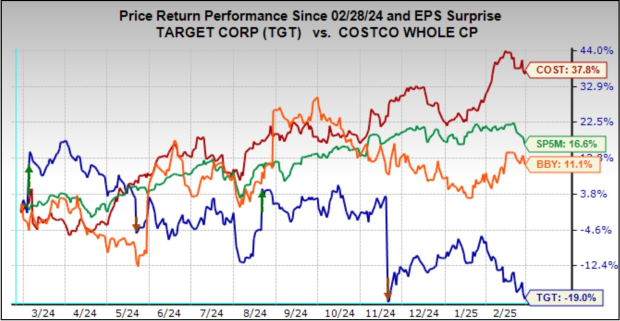

For the 26 reporting retailers, total Q4 earnings increased by +32.2% year-over-year, accompanied by a +6.9% rise in revenues. Notably, 73.1% of these companies surpassed EPS estimates, and a similar proportion exceeded revenue projections.

The charts below provide a historical context for the Q4 performance of these retailers.

Image Source: Zacks Investment Research

As illustrated, the percentage of companies beating consensus EPS estimates indicates substantial improvement compared to the prior two quarters, although it remains below the average of the last 20 quarters. Revenue beats are tracking favorably compared to recent trends and historical averages.

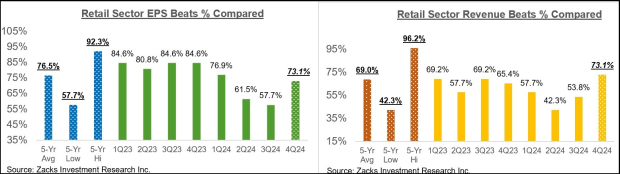

To provide context for the current elevated earnings growth, we consider the performance of this group with and without Amazon’s results, which are included among the 26 companies with reported earnings. Amazon’s Q4 earnings surged by +86.9% on +10.5% higher revenues, successfully beating both EPS and revenue forecasts.

The comparative charts below depict Q4 earnings and revenue growth relative to other recent periods, both including and excluding Amazon’s results.

Image Source: Zacks Investment Research

Retail Sector Earnings Growth Primarily Driven by Amazon

Current data shows that much of the earnings growth in the retail sector is attributable to Amazon. For Q4, the remaining retail group reporting has seen earnings increase by only +4.9%, with revenues up by +5.3%. This indicates that while inflationary trends are influencing top-line growth overall, Amazon continues to dominate the sector.

Q4 Earnings Season Overview

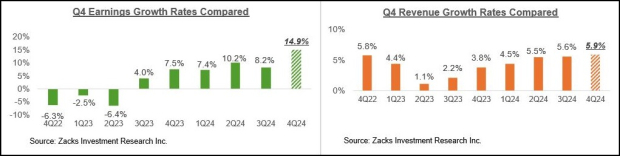

As of Friday, February 28th, Q4 results from 485 members of the S&P 500 have been reported, accounting for 97% of the index. Total earnings for these companies show a robust increase of +14.9% from the same quarter last year, alongside a +5.9% rise in revenues. Furthermore, 76.3% of these companies surpassed EPS estimates, while 65.4% exceeded revenue estimates.

The charts below illustrate the Q4 earnings and revenue growth rates relative to other recent periods for these index members.

Image Source: Zacks Investment Research

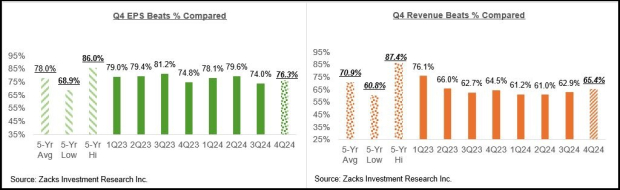

Additionally, the following charts present the percentages of Q4 EPS and revenue beats in comparison to other recent periods within the same group of companies.

Image Source: Zacks Investment Research

The Broader Earnings Landscape

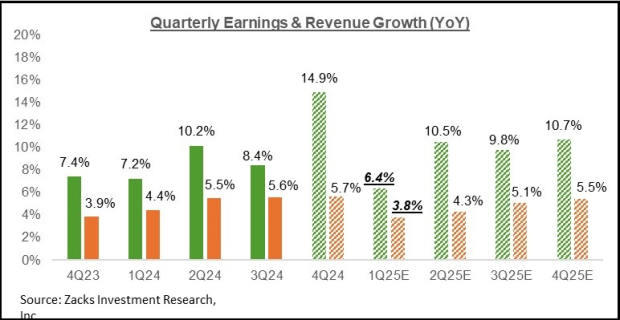

The chart below showcases Q4 earnings and revenue growth expectations, contextualized with growth trends from the previous four quarters and projections for the upcoming quarters.

Image Source: Zacks Investment Research

Without the contributions from the Magnificent Seven (Mag 7) companies, Q4 earnings for the remaining S&P 500 entities would show an increase of +10.1% and revenues rising by +4.7%.

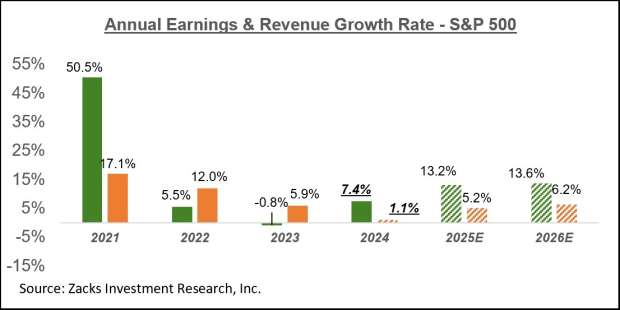

Below, the chart illustrates the overall earnings situation on a calendar-year basis, projecting double-digit earnings growth for 2025 and 2026.

Image Source: Zacks Investment Research

For a comprehensive view of the overall earnings environment and outlook, refer to our weekly Earnings Trends report >>>> Retail Earnings: An In-Depth Analysis

Top Stock Picks for the Coming Month

Recently released, financial experts have identified 7 top stocks from a pool of 220 Zacks Rank #1 Strong Buys, branded as “Most Likely for Early Price Pops.”

Since 1988, the complete list of recommendations has significantly outperformed the market, achieving an average annual return of +24.3%. These selected stocks merit close attention.

Interested in the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days at no cost. Click here for your free report now.

Explore detailed stock analyses such as:

Macy’s, Inc. (M): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

This piece originally appeared on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.