Qorvo Faces Challenges Despite Recent Stock Surge

Qorvo Inc. QRVO may have experienced a notable rebound this past week, highlighted by a 13.75% increase over five days, but investors should approach with caution. The chip manufacturer remains significantly down this year.

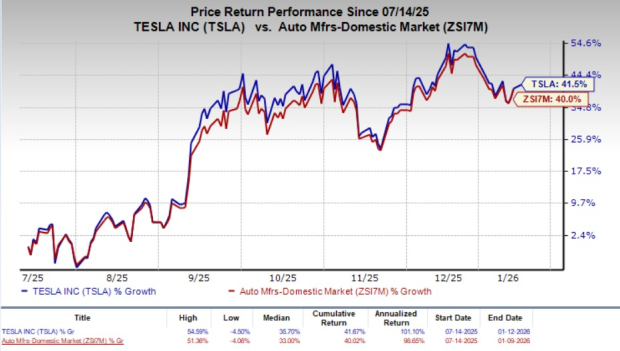

Chart created using Benzinga Pro

Starboard Takes a Stake in Qorvo

Over the last 12 months, QRVO shares have plummeted by 46.10%, and year-to-date, they have fallen 14.96%. Even the last month hasn’t provided relief, with QRVO stock losing nearly 19% of its value.

Amid this turmoil, activist hedge fund manager Jeffrey Smith of Starboard Value has made a noteworthy investment. Smith acquired a 7.76% stake in Qorvo, valued at approximately $8.27 million.

This significant move raises questions about the future of Qorvo and the intentions behind Starboard’s investment.

Technical Indicators Flash Warning Signs

Despite the recent stock uptick, technical analysis indicates continued bearish sentiment. Qorvo stock is currently trading below its five-day, 20-day, and 50-day exponential moving averages, suggesting persistent downward momentum. The Moving Average Convergence Divergence (MACD) shows a negative 4.48, further reinforcing this bearish outlook. Meanwhile, the Relative Strength Index (RSI) of 40.45 indicates that the stock is in a neutral position—not oversold or overbought—experiencing only mild buying pressure.

However, there is a flicker of optimism; Qorvo stock is trading at $58.38, above its eight-day simple moving average of $56.79. This suggests potential for short-term momentum. Nevertheless, the looming 20-day, 50-day, and 200-day simple moving averages act as significant resistance points, indicating that the overall trend remains cautious.

In conclusion, the recent bounce for Qorvo may represent a temporary upswing rather than a permanent recovery. With activist interest from Starboard, stakeholders should monitor Qorvo closely as Smith is likely to play an active role—possibly signaling a notable shift in the chip industry.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs