Embracing Monthly Income Within Nasdaq-100 with QQQI

In the financial jungle of 2024, tech stocks roar at the forefront of the market, steering U.S. equity indexes like the Nasdaq-100 to new heights. For those in pursuit of bountiful tech gains and tax-efficient monthly income, the NEOS Nasdaq 100 High Income ETF (QQQI) emerges as a compelling choice worth exploring.

The Nasdaq-100 index stands as a key beneficiary of the AI explosion, with Nvidia’s recent earnings surpassing expectations and propelling its stock to unprecedented levels. As of 01/26/24, Nvidia has surged by 60% YTD according to FactSet data, firmly securing its position as the third-largest holding by weight in the Nasdaq-100 at 5.62% as of 02/23/24.

Delving Into the Nasdaq-100’s Ascendance

The Nasdaq-100 index boasts the 100 largest securities trading on the Nasdaq Exchange, with a market cap-weighted structure that notably excludes the finance sector. While the index leans towards the information technology sector, stringent rules are in place to cap the maximum individual and sector weights permissible within the index.

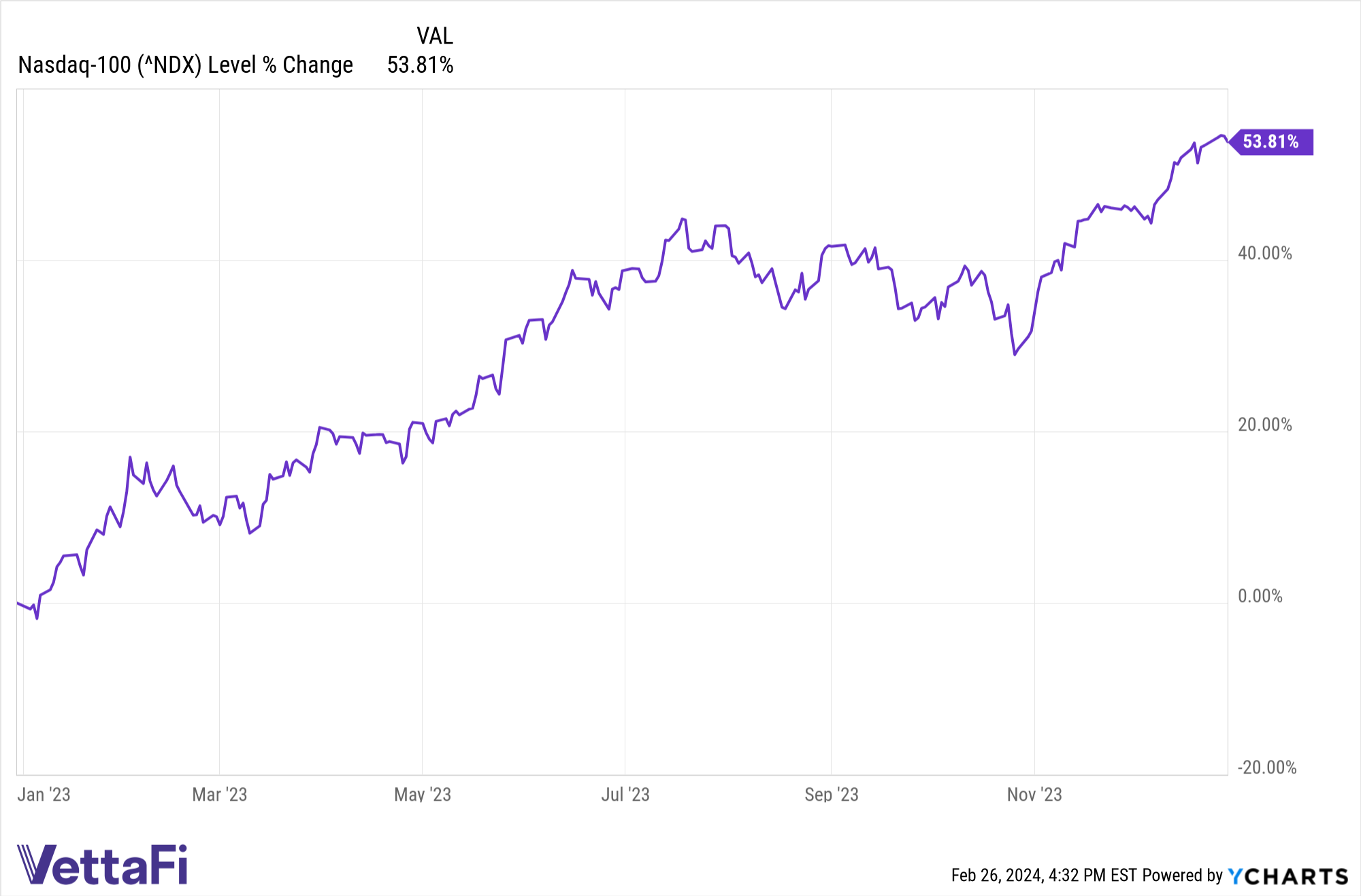

On a remarkable upswing, the Nasdaq-100 witnessed a staggering 53.81% surge in 2023 on a price returns basis. As of 01/26/24, the index continues to soar, currently marking a 6.83% increase for the year.

Despite murmurs of over-valuation and fears of an AI bubble tainting the tech realm, a divergence of perspectives persists. Some view the soaring tech industry as a speculative bubble waiting to burst, while others perceive it as the solid foundation for the forthcoming technological revolution.

Quoting Jamie Dimon, CEO of J.P. Morgan Chase, CNBC reported: “When we had the internet bubble the first time around … that was hype. This is not hype. It’s real. People are deploying it at different speeds, but it will handle a tremendous amount of stuff.”

Unleashing Potential: QQQI’s Innovative Approach

For investors eager to expand or complement their Nasdaq-100 exposure, the NEOS Nasdaq 100 High Income ETF (QQQI) presents an intriguing prospect. This fund aims to deliver generous monthly income by investing in the Nasdaq-100, leveraging an options strategy involving covered calls for premium generation.

QQQI offers a multi-layered tax-efficient framework for investors. The fund’s utilization of call options, qualifying as section 1256 contracts, garners favorable tax treatment under IRS regulations. Options held at the year’s end are treated as if sold at fair market value on the last market day, subjecting any resulting capital gains or losses to a tax rate of 60% long-term and 40% short-term, regardless of their duration.

In response to shifts in equity values, NEOS exhibits the flexibility to actively manage call options—extracting gains from underlying assets or mitigating losses as needed. Furthermore, the fund managers seize tax-loss harvesting opportunities year-round, be it on the call options, equity holdings, or both.

QQQI maintains a competitive expense ratio of 0.68%.

For more updates, insights, and analysis, explore the Tax-Efficient Income Channel.

The viewpoints expressed herein belong solely to the author and do not necessarily align with those of Nasdaq, Inc.